Loan Agreement Letter

What is a loan agreement letter?

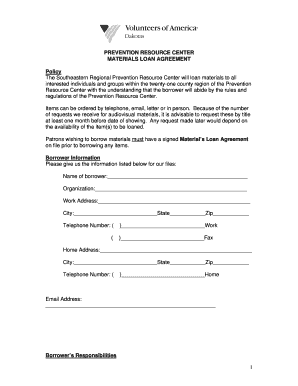

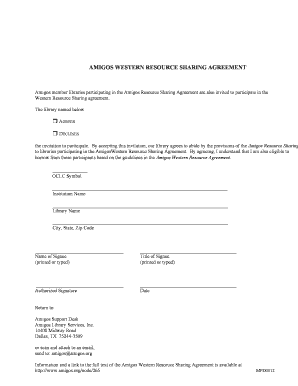

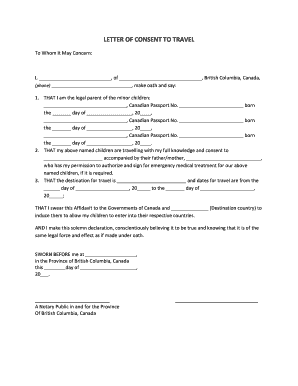

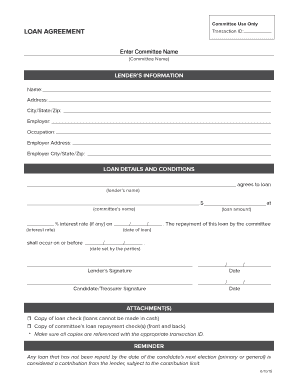

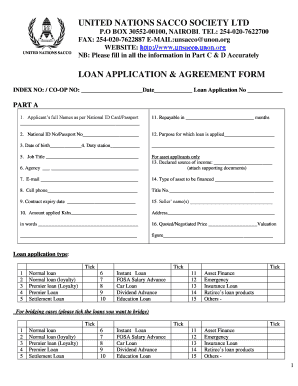

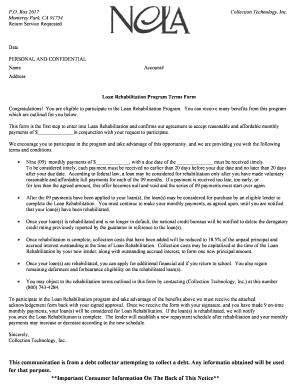

A loan agreement letter is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. It serves as a written record of the agreement, ensuring transparency and protecting the rights of both parties involved. The letter typically includes details such as the loan amount, interest rate, repayment terms, and any collateral or guarantees involved.

What are the types of loan agreement letter?

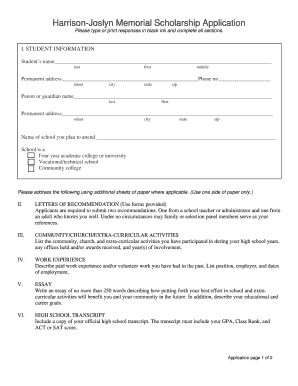

There are several types of loan agreement letters, each tailored to specific situations. The common types include: 1. Personal Loan Agreement: Used when borrowing or lending money between individuals 2. Business Loan Agreement: Pertains to loans for business purposes, including startups and expansion 3. Mortgage Loan Agreement: Relates to loans secured by real estate 4. Student Loan Agreement: Specifically designed for student loans 5. Auto Loan Agreement: Deals with loans for purchasing vehicles

How to complete a loan agreement letter

Completing a loan agreement letter can be done by following these steps: 1. Begin by identifying the parties involved: Clearly state the names and contact information of the lender and borrower. 2. Define the loan terms: Specify the loan amount, interest rate, repayment schedule, and any additional fees or charges. 3. Outline any collateral or guarantees: If applicable, describe any assets or guarantors involved in securing the loan. 4. Include default and dispute resolution provisions: Address how potential defaults or conflicts will be handled. 5. Sign and date the agreement: Both parties should sign and date the letter to indicate their acceptance and understanding of the terms.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.