Business Loan Agreement

What is a business loan agreement?

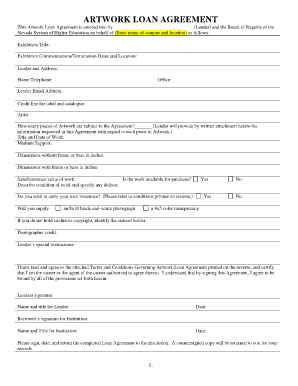

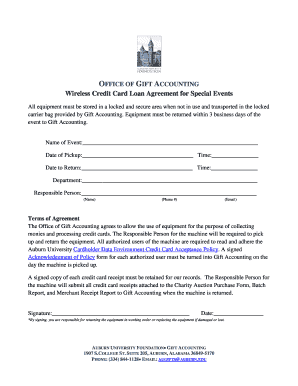

A business loan agreement is a legally binding contract between a lender and a borrower. It outlines the terms and conditions under which the lender provides a loan to the borrower for business purposes. The agreement specifies the loan amount, interest rate, repayment schedule, collateral (if any), and other important details.

What are the types of business loan agreements?

There are various types of business loan agreements, including:

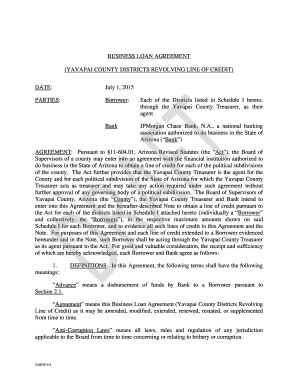

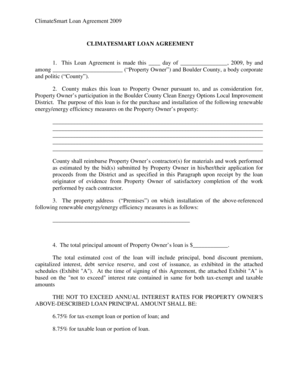

Term loan agreement: This is a common type of business loan agreement where the borrower receives a lump sum amount and repays it over a fixed period of time with interest.

Line of credit agreement: In this type of agreement, the lender provides a predetermined credit limit that the borrower can borrow from as needed. The borrower only pays interest on the amount borrowed.

Equipment financing agreement: This agreement is used when the borrower needs financing specifically for purchasing equipment or machinery for their business.

Invoice financing agreement: With this agreement, the lender advances funds to the borrower based on their outstanding invoices, providing immediate cash flow while waiting for customers to pay.

Merchant cash advance agreement: This type of agreement involves the lender providing a lump sum payment to the borrower in exchange for a percentage of future credit card sales.

Small Business Administration (SBA) loan agreement: SBA loans are guaranteed by the U.S. Small Business Administration and have specific requirements and terms set by the government.

How to complete a business loan agreement

Completing a business loan agreement involves the following steps:

01

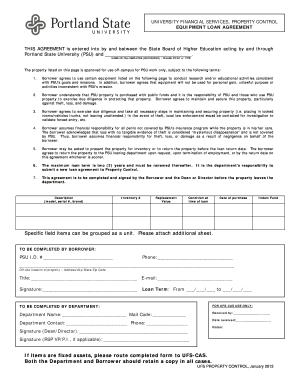

Gather all necessary information and documents, such as financial statements, business plans, and personal identification.

02

Review the terms and conditions of the agreement thoroughly, including interest rate, repayment schedule, and any collateral requirements.

03

Fill in the required fields of the loan agreement form accurately and completely.

04

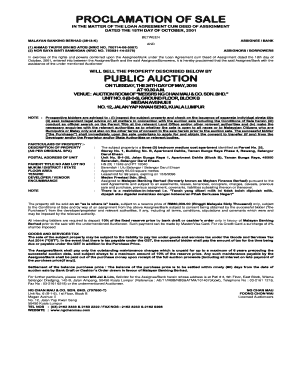

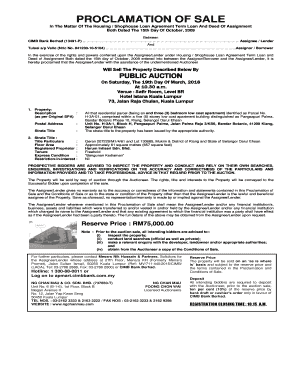

Ensure all parties involved sign the agreement.

05

Keep a copy of the signed agreement for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out business loan agreement

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a business loan agreement?

What Is a Business Loan Agreement? A business loan agreement is a legally binding document that outlines the details of a loan between a lender and borrower. Loan agreements typically include information like the loan amount, repayment term and due dates, interest rates and other costs.

Can a loan agreement be handwritten?

There are no legal differences between typed and handwritten agreements when it comes to enforceability. When most people think of a contract, a formally typed, the professional contract usually comes to mind. Nonetheless, a handwritten contract can be as valid as one that's typed.

How do I write a business loan agreement?

How to Write a Business Loan Agreement Step 1 – Set an Effective Date. Step 2 – Identify the Parties. Step 3 – Include the Loan Amount. Step 4 – Create a Repayment Schedule. Step 5 – Define Security Interests or Collateral. Step 6 – Set an Interest Rate. Step 7 – Late Payment Fees. Step 8 – Determine Prepayment Options.

How do I write a simple loan agreement?

A personal loan agreement should include the following information: Names and addresses of the lender and the borrower. Information about the loan cosigner, if applicable. Amount borrowed. Date the loan was provided. Expected repayment date. Interest rate, if applicable. Annual percentage rate (APR), if applicable.

Can I write my own loan agreement?

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

What is business loan and how does it work?

Business loans provide business owners with financing either as a lump-sum payment or credit line. In exchange for this funding, your business agrees to repay the money it borrows over time, plus interest and fees.

Related templates