Loan Agreement Template - Page 2

What is Loan Agreement Template?

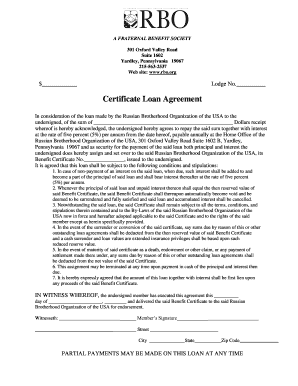

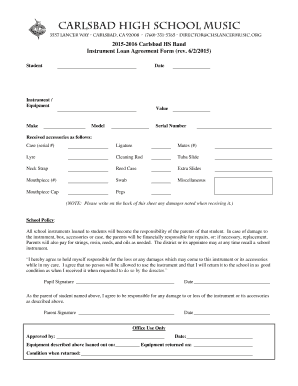

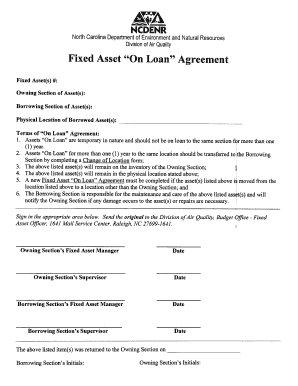

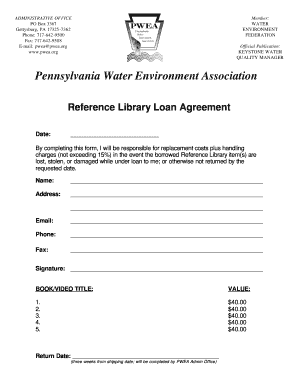

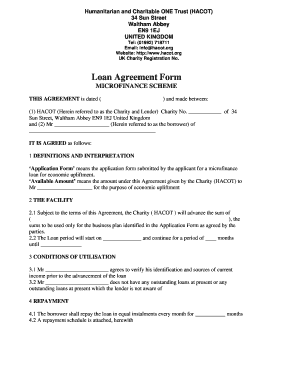

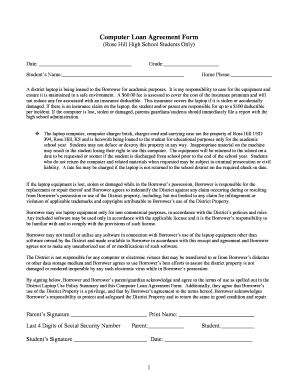

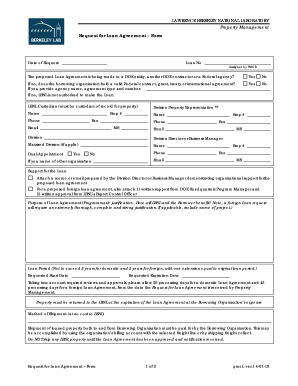

A Loan Agreement Template is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. It provides a framework for the loan transaction and helps protect the interests of both parties. This document specifies the loan amount, the repayment schedule, the interest rate, and any additional terms or conditions that may apply. By using a Loan Agreement Template, borrowers and lenders can ensure that their loan agreement is clear, comprehensive, and legally enforceable.

What are the types of Loan Agreement Template?

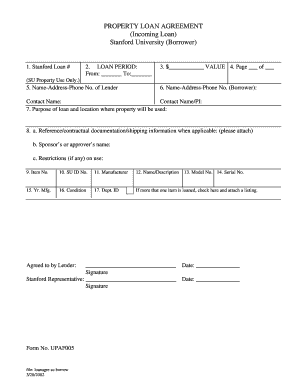

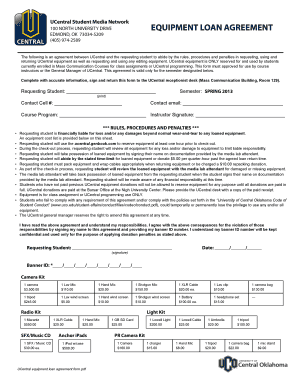

There are several types of Loan Agreement Templates available, depending on the specific needs and circumstances of the loan. Some common types include: 1. Personal Loan Agreement: Used for loans between individuals or friends and family members. 2. Business Loan Agreement: Used for loans made to a business entity, such as a corporation or partnership. 3. Mortgage Loan Agreement: Used for loans secured by real estate property. 4. Car Loan Agreement: Used for loans made to finance the purchase of a vehicle. 5. Student Loan Agreement: Used for loans made to students to finance their education.

How to complete Loan Agreement Template

Completing a Loan Agreement Template is a simple and straightforward process. Here are the steps to follow: 1. Download or access a Loan Agreement Template: Choose a template that suits your specific loan type from a reliable source, such as pdfFiller. 2. Fill in the borrower and lender details: Provide the necessary information about both parties, including their names, addresses, and contact information. 3. Specify the loan terms: Enter the loan amount, the repayment schedule, and the interest rate. You can also include any additional terms or conditions that are relevant to the loan. 4. Review and edit the agreement: Carefully review the completed Loan Agreement Template and make any necessary changes or additions. 5. Sign the agreement: Both the borrower and the lender should sign the document to make it legally binding. 6. Share or store the agreement: Once the Loan Agreement Template is completed and signed, you can share it with the other party and store it for future reference if needed.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.