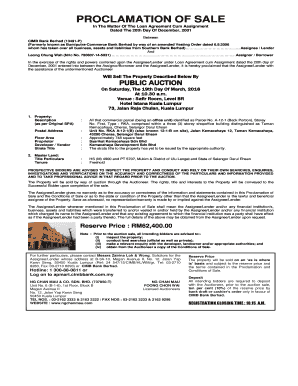

Business Loan Agreement

What is business loan agreement?

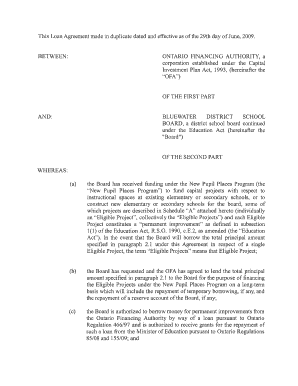

A business loan agreement is a legal contract between a lender and a borrower that outlines the terms and conditions of a loan for a business. It specifies the amount of the loan, the interest rate, the repayment schedule, and any other relevant details. The agreement serves as a protection for both parties involved, ensuring that both the lender and borrower have a clear understanding of their rights and obligations.

What are the types of business loan agreement?

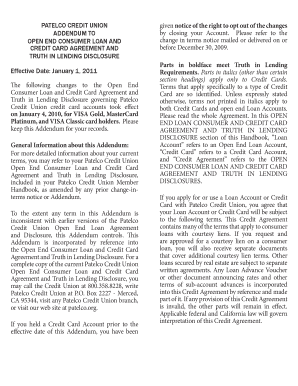

There are several types of business loan agreements, depending on the specific needs and circumstances of the borrower. Some common types include: 1. Term Loan Agreement: This type of agreement provides a lump sum loan that is repaid over a fixed period of time. 2. Line of Credit Agreement: This agreement allows the borrower to access a predetermined amount of money as needed, up to a certain limit. 3. Equipment Loan Agreement: This agreement is used when a borrower needs financing to purchase or lease equipment for their business. 4. Small Business Administration (SBA) Loan Agreement: These agreements are backed by the U.S. Small Business Administration and often come with favorable terms and conditions for small businesses. 5. Personal Guarantee Agreement: In some cases, a lender may require a personal guarantee from the business owner, making them personally liable for the loan if the business is unable to repay it.

How to complete business loan agreement

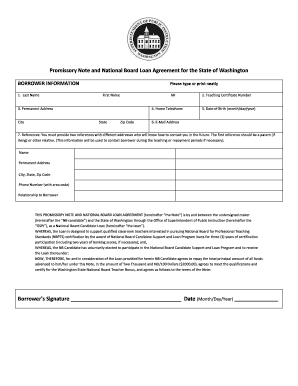

Completing a business loan agreement can be a straightforward process if you follow these steps: 1. Review the agreement: carefully read through the entire loan agreement, making sure you understand all terms and conditions. 2. Fill in the required information: provide accurate information regarding the loan amount, interest rate, repayment terms, and any other necessary details. 3. Seek legal advice if needed: if you're unsure about any aspect of the agreement, it's recommended to consult with a lawyer who specializes in business law. 4. Sign the agreement: once you have reviewed and filled in all required information, sign the agreement along with the lender. 5. Keep a copy: make sure to keep a copy of the signed agreement for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.