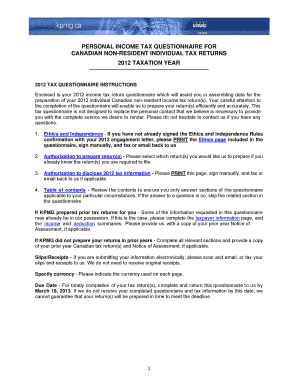

Non-resident Questionnaire

What is Non-resident Questionnaire?

The Non-resident Questionnaire is a form that is used to gather information from individuals who are not residents of a particular country. This questionnaire helps authorities collect data about non-residents and their activities within the country.

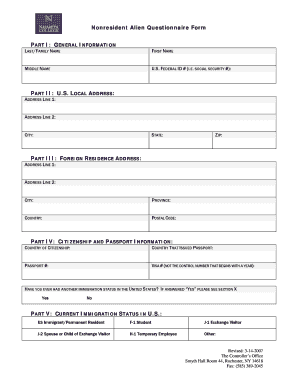

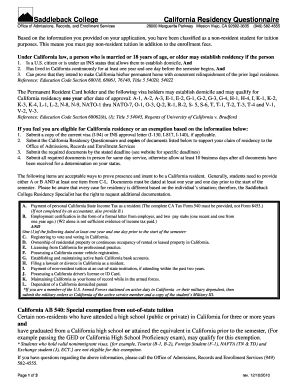

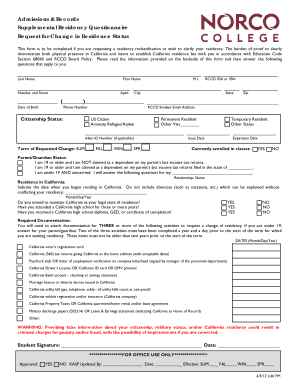

What are the types of Non-resident Questionnaire?

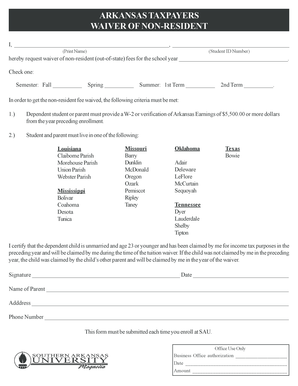

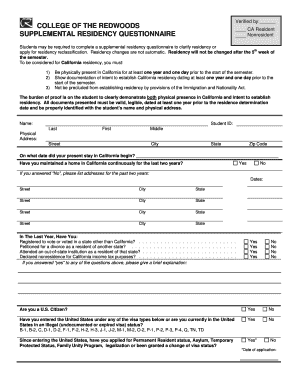

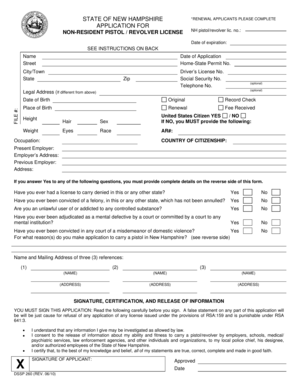

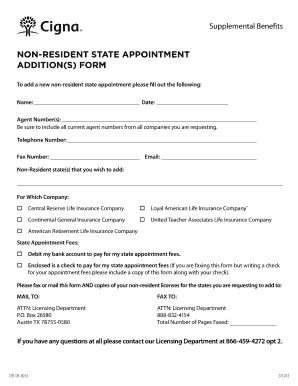

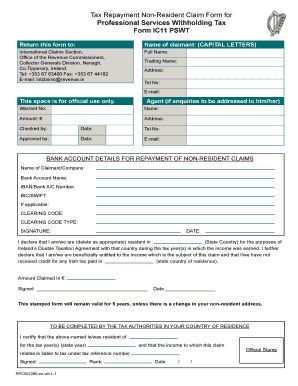

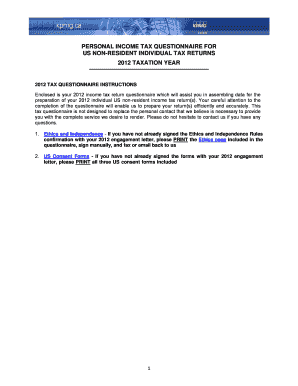

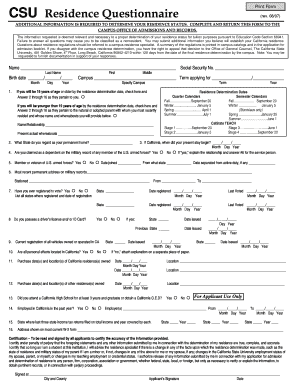

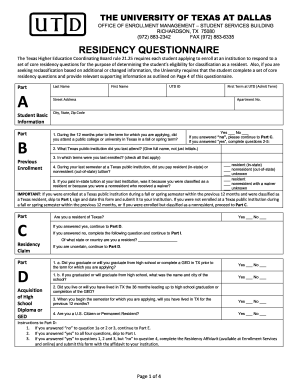

There are several types of Non-resident Questionnaires designed to cater to different purposes. Some common types include:

How to complete Non-resident Questionnaire

Completing the Non-resident Questionnaire is a simple and straightforward process. Here are the steps you need to follow:

pdfFiller is an online platform that empowers users to easily create, edit, and share documents online. With its unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to efficiently complete their Non-resident Questionnaires and any other document related tasks.