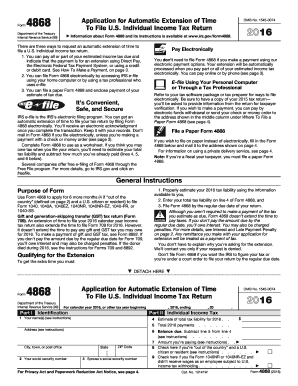

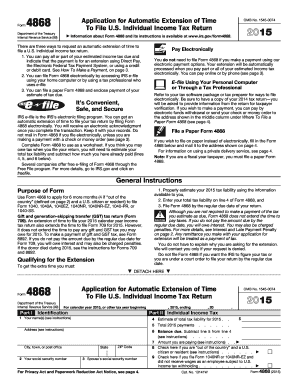

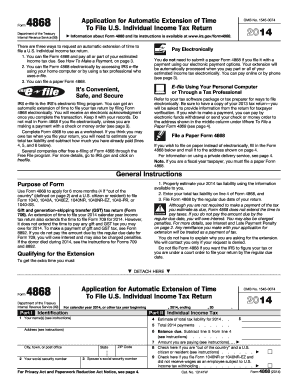

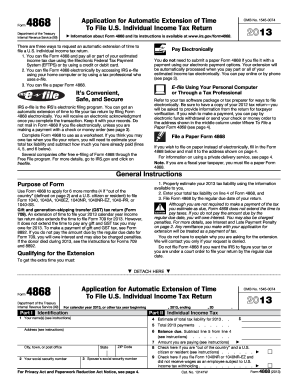

4868 Form

Video Tutorial How to Fill Out 4868 Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can I file an extension over the phone?

You can file Form 4868 by phone anytime through April 15 (or the following business day, if on a weekend or holiday). The special toll-free phone number is 1-888-796-1074. Use Form 4868 as a worksheet to prepare for the call and have a copy of your previous year's federal income tax return available.

Does it cost to file an extension with the IRS?

Free File: Everyone Can File an Extension for Free Please be aware that filing an extension gives you time to e-file your federal tax return. If you have a balance due, the deadline to pay is still April 18, 2022. However, if you want to file your taxes now with free, easy to use software use IRS Free File.

How do I extend my tax deadline 2022?

To request an extension to file your federal taxes after April 18, 2022, print and mail Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. We can't process extension requests filed electronically after April 18, 2022. Find out where to mail your form.

How do I file an extension with the IRS?

You may file your extension in any one of three ways listed below: Pay all or part of your estimated income tax due and indicate that the payment is for an extension using IRS Direct Pay, EFTPS: The Electronic Federal Tax Payment System, or a credit or debit card. You'll receive a confirmation number for your records.

How do I file a tax extension electronically?

You can e-File Form 4868 or Form 2350 for free on eFile.com. After you have e-Filed an IRS accepted tax extension, you can complete your 2021 Tax Return by October 15 October 17, 2022. all your tax extension information will be in your eFile.com account when you e-file.

How do I file a tax extension for 2022?

To request an extension to file your federal taxes after April 18, 2022, print and mail Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return.

Related templates