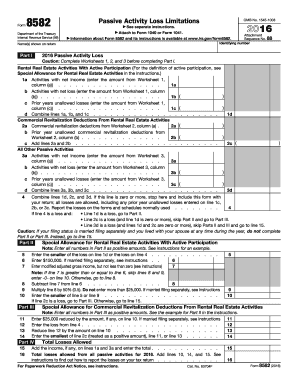

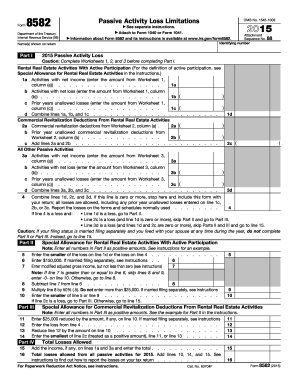

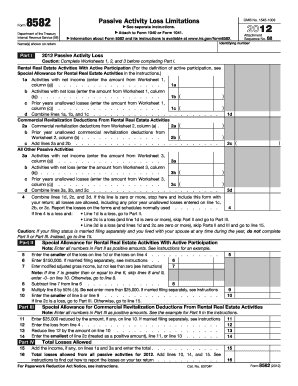

8582 Form

What is 8582 Form?

The 8582 Form refers to a tax form used by individuals to report passive activity losses and credits. It is specifically designed for taxpayers who have rental real estate, partnerships, S corporations, trusts, or estates. By completing this form, taxpayers can determine the allowable amount of passive activity losses to deduct from their taxable income. It is an essential document for those involved in passive activities to accurately report their financial information to the Internal Revenue Service (IRS).

What are the types of 8582 Form?

There are different types of 8582 Forms, each catering to specific situations:

How to complete 8582 Form

Completing the 8582 Form is a straightforward process. Here is a step-by-step guide:

By utilizing pdfFiller, completing the 8582 Form becomes even more convenient. With pdfFiller, you have the power to create, edit, and share your documents online. It offers a wide range of fillable templates and robust editing tools, making it the only PDF editor you need to efficiently handle your document requirements. Take advantage of pdfFiller's user-friendly interface and extensive features to streamline your document workflow and stay organized during tax season. Start using pdfFiller today and experience the benefits of its comprehensive document management solution.