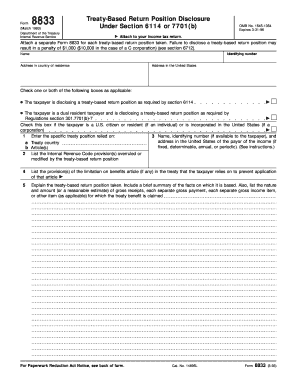

8833 Form

What is 8833 Form?

The 8833 Form, also known as the Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b), is a form required by the Internal Revenue Service (IRS) for individuals who are eligible to claim treaty benefits on their U.S. tax returns. This form is used to disclose the individual's intent to apply a treaty provision to reduce or eliminate their U.S. tax liability. By completing this form, the individual provides the IRS with specific information about the treaty provision they are relying on and the corresponding article of the treaty.

What are the types of 8833 Form?

There are two types of 8833 Forms that individuals may need to complete: - Category A: This form is used when individuals claim treaty-based positions that are unrelated to claiming a reduced rate of withholding tax on earnings. - Category B: This form is used when individuals claim treaty-based positions that are related to claiming a reduced rate of withholding tax on earnings.

How to complete 8833 Form

To complete the 8833 Form, follow these steps:

By following these steps, you can ensure that your 8833 Form is complete and accurately discloses your treaty-based position to the IRS.