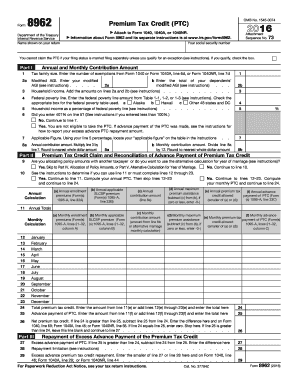

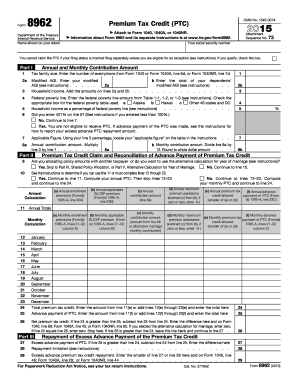

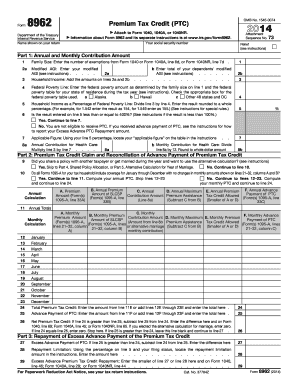

8962 Form

What is 8962 Form?

The 8962 Form, also known as the Premium Tax Credit (PTC) form, is a document used by individuals and families who have obtained health insurance through the Affordable Care Act (ACA) Marketplace. It is an important form that determines if you are eligible for the Premium Tax Credit, which helps reduce your monthly health insurance premiums. By completing the 8962 Form correctly, you can ensure that you are receiving the correct amount of financial assistance for your health insurance costs.

What are the types of 8962 Form?

There is only one type of 8962 Form, which is used to calculate and reconcile the Premium Tax Credit. However, the form may differ depending on the tax year for which you are filing. It is crucial to use the correct year's form to avoid any discrepancies or errors in your tax return.

How to complete 8962 Form

Completing the 8962 Form can be a straightforward process if you have all the necessary information and follow these step-by-step instructions:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.