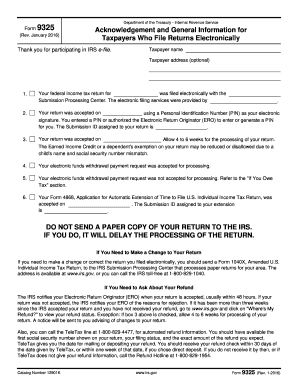

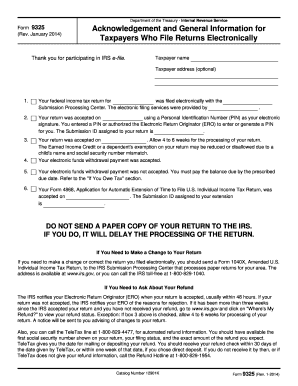

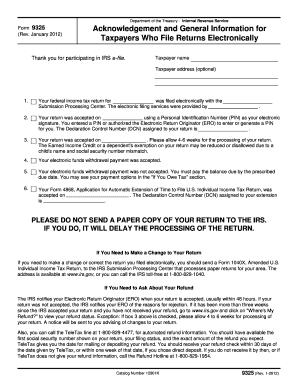

9325 Form

What is 9325 Form?

A 9325 Form is a document used for...

What are the types of 9325 Form?

There are several types of 9325 Forms...

Type 1

Type 2

Type 3

How to complete 9325 Form

Completing a 9325 Form is a straightforward process...

01

Start by reviewing the instructions provided with the form

02

Gather all the necessary information and documentation

03

Carefully fill out the required fields in the form

04

Double-check all the information for accuracy

05

Sign and date the form

06

Save a copy of the completed form for your records

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 9325 Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the purpose of form 9325?

Form 9325, Acknowledgement and General Information for Taxpayers Who File Returns Electronically can be used to convey information to customers by an Electronic Return Originator (ERO), and would be completed by the ERO as the filer of the return.

How do I get an e file Acknowledgement receipt?

Step 1: Log in to the Income Tax E-Filing website and click on “View Returns / Forms” link. Step 2: Select the option “Income Tax Return” and “Assessment Year”. Click “Submit”. Step 3: Click on acknowledgement number of the income tax return for which you want to download ITR-V.

What is the purpose of form 8879?

What's New. Form 8879 is used to authorize the electronic filing (e-file) of original and amended returns. Use this Form 8879 (Rev. January 2021) to authorize e-file of your Form 1040, 1040-SR, 1040-NR, 1040-SS, or 1040- X, for tax years beginning with 2019.

How do I request an IRS authorization?

Tax Information Authorization You can use Form 8821 to allow the IRS to discuss your tax matters with designated third parties and, where necessary, to disclose your confidential tax return information to those designated third parties on matters other than just the processing of your current tax return.

What is an IRS authorization letter?

More In Forms and Instructions Authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally or in writing for the type of tax and the years or periods listed on the form.

Can I file my 1040 electronically?

Answer: Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

Related templates