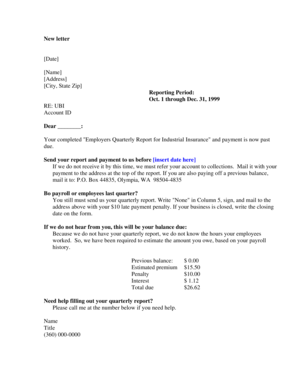

Past Due Payment Letter

What is a past due payment letter?

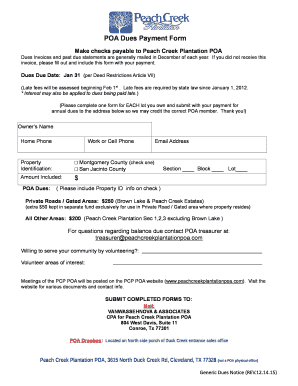

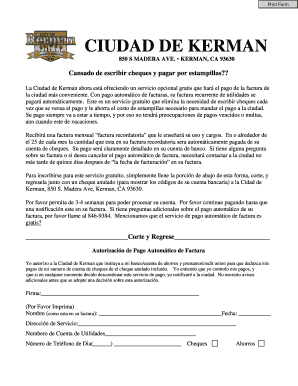

A past due payment letter, also known as a payment reminder letter or a late payment letter, is a written communication that is sent to a customer or a client who has failed to make a payment by the agreed-upon due date. This letter serves as a gentle reminder to the recipient to settle their outstanding payment as soon as possible.

What are the types of past due payment letters?

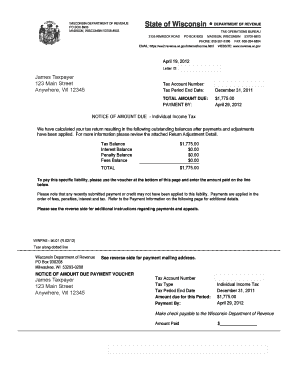

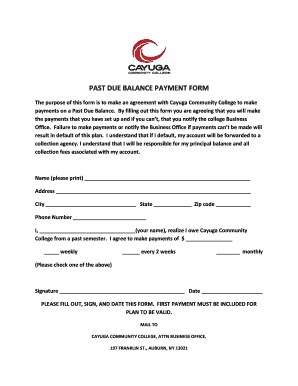

There are several types of past due payment letters depending on the nature of the business and the relationship with the customer or client. Some common types include: 1. First Reminder Letter: This is the initial letter sent after the payment has become past due. 2. Second Reminder Letter: If the first reminder letter does not yield any response, a second reminder letter can be sent to emphasize the urgency of the payment. 3. Final Notice Letter: This is the last notification before taking legal action or engaging a collection agency.

How to complete a past due payment letter

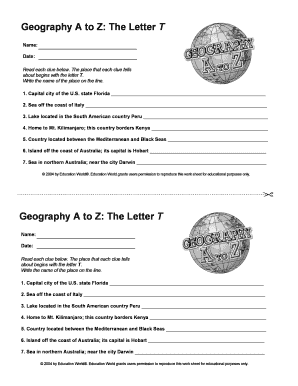

Completing a past due payment letter is a straightforward process that requires attention to detail and clear communication. Here are the steps to follow: 1. Start with a friendly opening: Address the recipient politely and remind them of their overdue payment. 2. Clearly state the outstanding amount: Mention the specific amount that needs to be paid, including any additional charges or late fees. 3. Provide payment instructions: Include details on how the payment can be made, such as acceptable payment methods and deadlines. 4. Express consequences of non-payment: Clearly state the consequences of further delay or non-payment, which may include legal action or credit reporting. 5. End on a positive note: Express your hope for prompt payment and gratitude for their attention to this matter.

pdfFiller empowers users to create, edit and share their documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor for getting documents done efficiently and effectively.