90 Days Past Due Letter

What is 90 days past due letter?

A 90 days past due letter is a written communication sent to individuals or businesses who have failed to make payment on a debt for a period of 90 days. This letter serves as a reminder and request for payment, indicating that the payment is significantly overdue and encouraging prompt action to resolve the outstanding debt.

What are the types of 90 days past due letter?

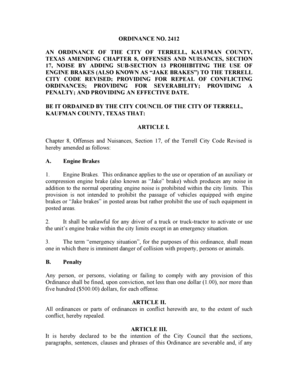

There are several types of 90 days past due letters, depending on the specific circumstances and the relationship between the creditor and the debtor. Some common types include: 1. Reminder letter: A simple letter reminding the debtor about the overdue payment and urging them to take immediate action. 2. Notice of intent to pursue legal action: This letter warns the debtor about the consequences of non-payment and informs them of the creditor's intention to take legal action if the debt is not settled. 3. Final notice letter: This letter serves as a final warning before the creditor proceeds with legal action or hands over the debt to a collections agency.

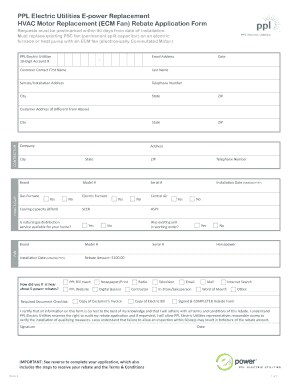

How to complete 90 days past due letter?

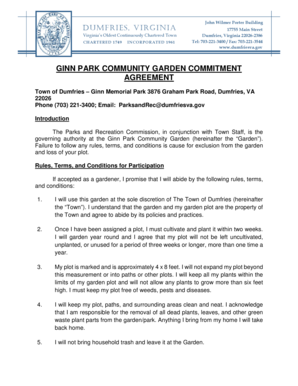

Completing a 90 days past due letter involves several steps to ensure its effectiveness. Here is a simple guide to help you: 1. Begin with a polite and professional tone, addressing the debtor by name. 2. Clearly state the purpose of the letter, mentioning the overdue payment and the number of days it has been outstanding. 3. Provide details of the debt, including the amount owed, any additional fees or interest charges, and the original due date. 4. Clearly outline the consequences of continued non-payment, such as legal action or credit damage. 5. Specify a deadline for the debtor to respond or make payment. 6. Include your contact information and preferred method of payment. 7. End the letter with a polite closing and a sense of urgency.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.