What is probate form de-120?

Probate form DE-120 is a legal document used in the probate process to provide necessary information to the court. It is used to open a probate case and begin the process of distributing the assets of a deceased person's estate. This form includes details such as the deceased person's name, date of death, and information about their heirs and beneficiaries.

What are the types of probate form de-120?

Probate form DE-120 comes in three different types, depending on the specific case involved. The types are as follows:

Form DE-Petition for Probate

Form DE-120(MN): Petition for Probate – Missing Witnesses

Form DE-120(MT): Petition for Probate – Multiple Wills

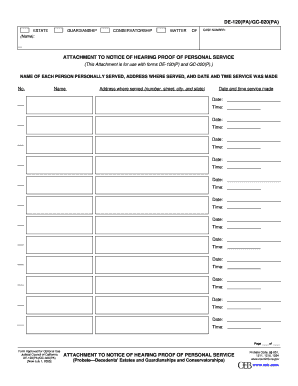

How to complete probate form de-120

Completing probate form DE-120 requires attention to detail and accuracy. Here is a step-by-step guide to filling out the form:

01

Gather all necessary information, including the deceased person's full legal name, date of death, and information about their heirs and beneficiaries.

02

Carefully read the instructions provided with the form to ensure you understand each section.

03

Begin by completing the header section, which includes the case number and court name.

04

Provide the requested information about the deceased person, including their date of death and whether they had a will.

05

Fill out the sections related to the deceased person's heirs and beneficiaries, providing their full names and contact information.

06

Include any additional information or attachments requested in the form.

07

Review the completed form for accuracy and make any necessary corrections.

08

Sign and date the form in the appropriate sections.

09

File the completed form with the court, following the specific filing instructions provided.

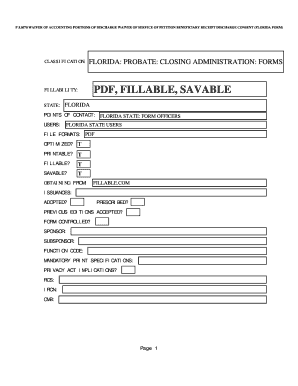

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.