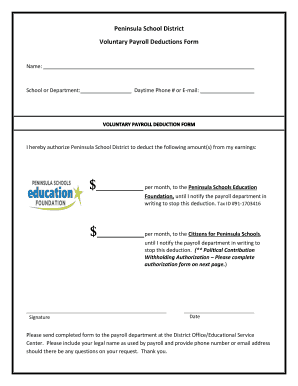

Voluntary Payroll Deduction Authorization Form

What is voluntary payroll deduction authorization form?

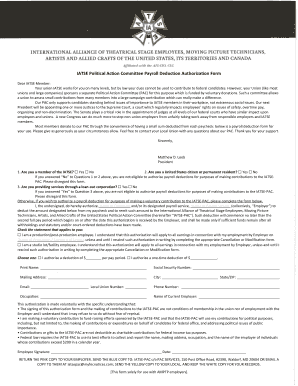

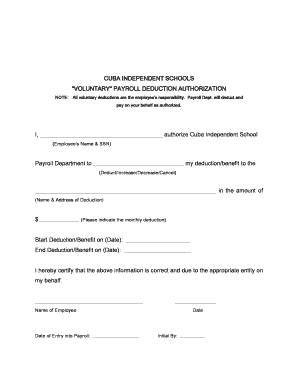

A voluntary payroll deduction authorization form is a document that allows an employee to give consent to their employer to deduct a certain amount from their paycheck for various purposes, such as retirement contributions, insurance premiums, or charitable donations.

What are the types of voluntary payroll deduction authorization form?

There are several types of voluntary payroll deduction authorization forms based on the purpose of the deduction. Some common types include:

401(k) contribution form

Health insurance premium deduction form

Charitable donation deduction form

Student loan repayment authorization form

How to complete voluntary payroll deduction authorization form

Completing a voluntary payroll deduction authorization form is a simple process. Here are the steps to follow:

01

Fill in your personal information, such as name, address, and employee ID

02

Specify the purpose of the deduction and the amount to be deducted

03

Sign and date the form to give your consent

04

Submit the form to your employer for processing

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out voluntary payroll deduction authorization form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Why would workers choose to take voluntary payroll deductions?

Employees may choose to have more money taken out of their paycheck to cover the cost of various benefits. These are known as voluntary payroll deductions and they can be withheld on a pretax basis (if allowed under Section 125 of the Internal Revenue Code) or post-tax basis.

What is a voluntary payroll deduction form?

Voluntary paycheck deductions are taken for programs in which individuals participate voluntarily, e.g., health insurance, dental insurance, retirement, etc. Participation in these programs may require that the individual complete a written salary reduction agreement authorizing payroll deductions.

Are payroll deductions voluntary?

All withholdings are mandatory. Deductions are usually voluntary, and they include opt-in retirement savings, health insurance, or donations. There are also some involuntary deductions, like when wages are garnished to pay back taxes or child support.

What is payroll authorization?

Payroll Authorization means a Participant's written authorization to withhold from his wages, specified percentages which shall be as either a Salary Deferral Contribution or Matched Voluntary Contribution or Nonmatched Voluntary Contribution contributed to this Plan on his behalf. Sample 1Sample 2.