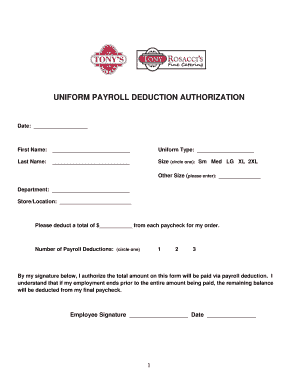

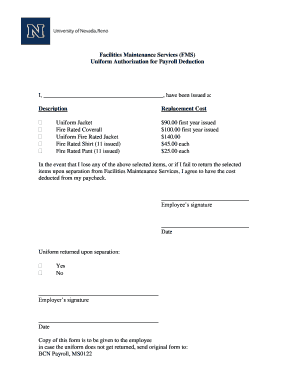

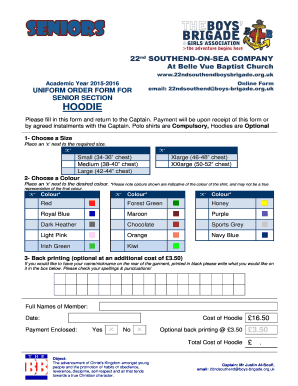

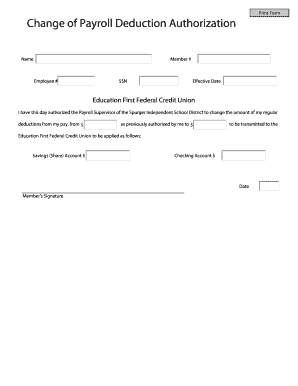

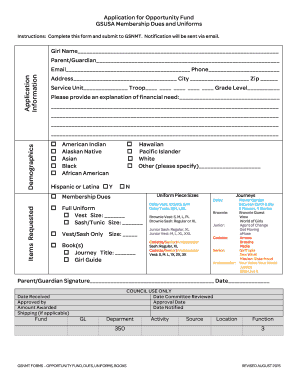

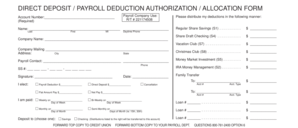

Payroll Deduction Authorization Form For Uniforms

What is payroll deduction authorization form for uniforms?

A payroll deduction authorization form for uniforms is a document that enables employees to authorize deductions from their salary for the purpose of purchasing uniforms. This form acts as a written consent from the employee to allow the employer to deduct a specific amount from their paycheck to cover the cost of uniforms.

What are the types of payroll deduction authorization form for uniforms?

There are several types of payroll deduction authorization forms for uniforms, including:

How to complete payroll deduction authorization form for uniforms

Completing a payroll deduction authorization form for uniforms is a simple process. Here are the steps to follow:

pdfFiller is a powerful online platform that empowers users to create, edit, and share documents, including payroll deduction authorization forms for uniforms. With unlimited fillable templates and a range of powerful editing tools, pdfFiller is the go-to PDF editor that ensures efficient completion of all your document needs.