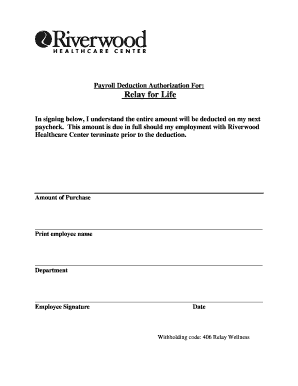

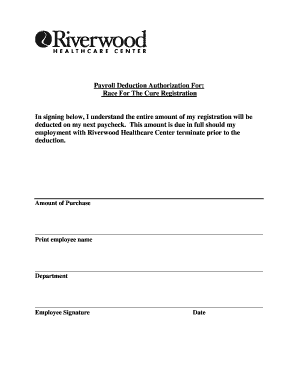

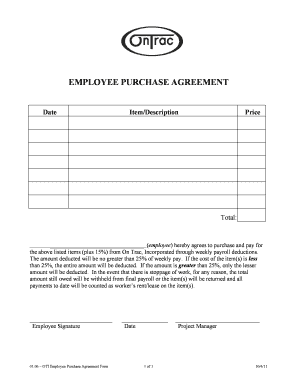

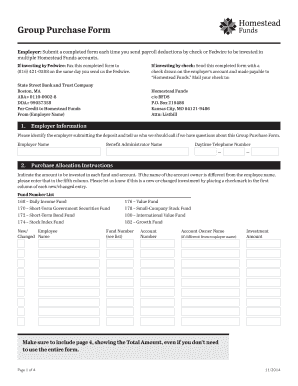

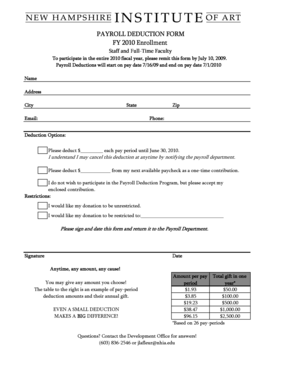

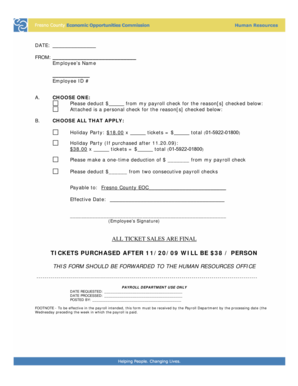

Payroll Deduction Form For Employee Purchases

What is payroll deduction form for employee purchases?

A payroll deduction form for employee purchases is a document that allows employees to make purchases through automatic deductions from their paychecks. This form authorizes the employer to deduct a specific amount from the employee's wages to cover the cost of the purchase. It is a convenient way for employees to make purchases without having to pay upfront or take out loans.

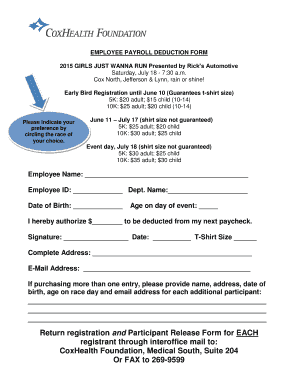

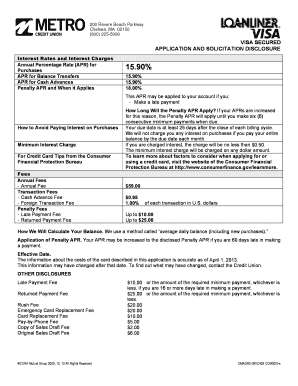

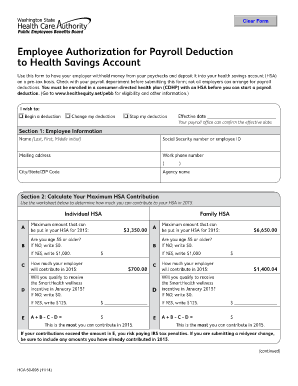

What are the types of payroll deduction form for employee purchases?

There are different types of payroll deduction forms for employee purchases, depending on the specific needs and policies of the company. The most common types include:

How to complete payroll deduction form for employee purchases

Completing a payroll deduction form for employee purchases is a straightforward process. Here are the steps to follow:

By using pdfFiller, you can effortlessly create, edit, and share your payroll deduction forms online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done quickly and efficiently.