Proposal Management Tool for Debt Consolidation Companies that propels your deals forward

What makes pdfFiller an excellent Proposal Management Tool for Debt Consolidation Companies?

Trusted RFP management software

pdfFiller’s Proposal Management Tool for Debt Consolidation Companies: Create and manage, and keep an eye on your proposals trouble-free

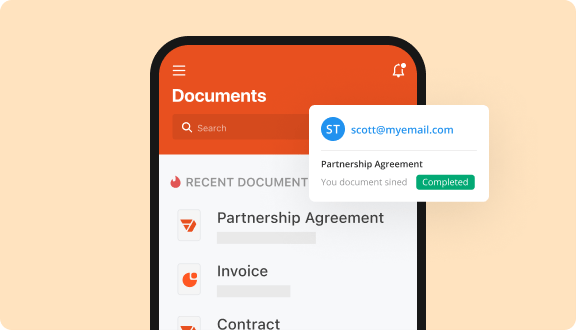

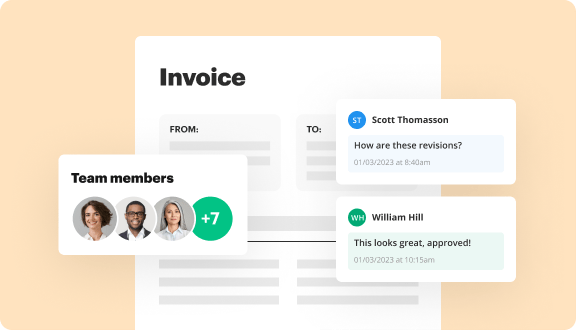

Whether you’re assembling a Request for Proposal (RFP) or find yourself on the other side of a review and negotiation process, pdfFiller’s Proposal Management Tool for Debt Consolidation Companies is here to facilitate and streamline the process of closing your deal.

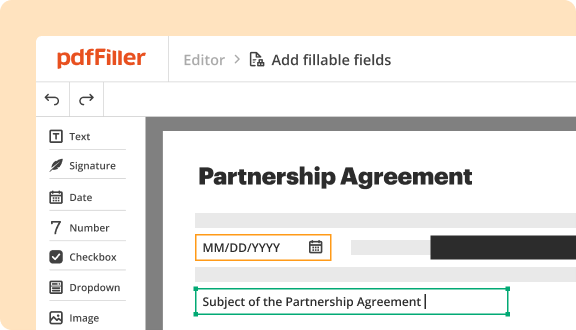

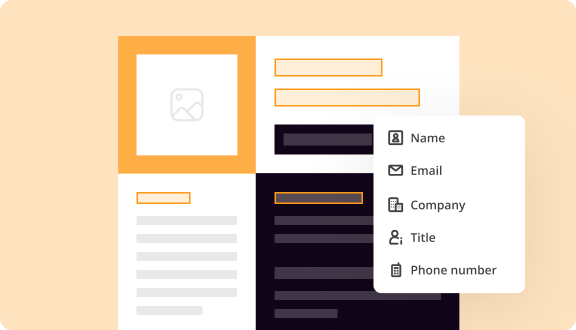

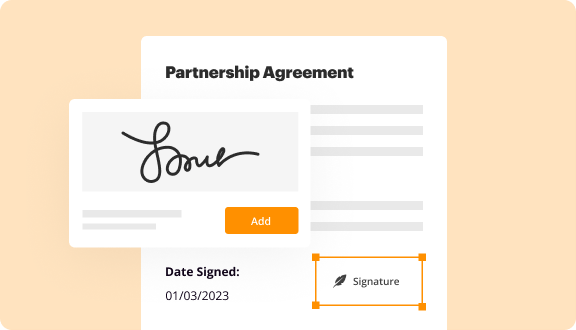

Though "pdfFiller" might hint otherwise, our platform works with a variety of document formats and comes with various proposal management features that let you modify existing paperwork or create ones from scratch. You can also convert them into easy-to-share and -embed fillable forms for smooth data collection. Transform any file into a reusable template, leaving less room for error and operational inefficiencies. Follow the steps below to start making the most of pdfFiller.

Getting started with Debt Consolidation Companies Proposal Management Tool to create and collaborate on your first proposal

You don’t need expensive RFP solutions when you have pdfFiller, a trustworthy Proposal Management Tool for Debt Consolidation Companies, at the ready. It strikes a balance between power and performance, offering a robust toolkit and intuitive interface for efficient proposal management.

Sign up for your free trial and redefine your document-centric processes today!

Every proposal management tool you need to close deals fast

Why pdfFiller wins

Cloud-native PDF editor

Top-rated for ease of use

Unlimited document storage

Unmatched cost-to-value

Industry-leading customer service

Security & compliance

Streamline Your Proposal Management with Our Tool for Debt Consolidation Companies

Elevate your proposal process with our Proposal Management Tool designed specifically for debt consolidation companies. This tool empowers you to propel your deals forward with ease. Instead of spending countless hours managing proposals, focus on helping your clients achieve financial freedom.

Key Features

Use Cases and Benefits

Our Proposal Management Tool addresses common challenges faced by debt consolidation companies. By simplifying the proposal process, you reduce stress and headaches associated with manual tracking and document management. Ultimately, this tool allows you to focus on what matters most: helping your clients regain control of their finances.