Free Tax Invoice Word Templates - Page 3

What are Tax Invoice Templates?

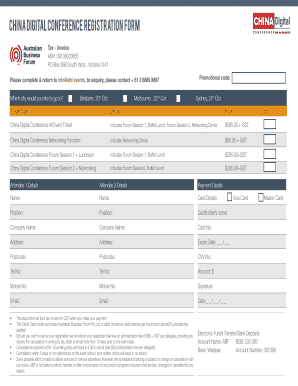

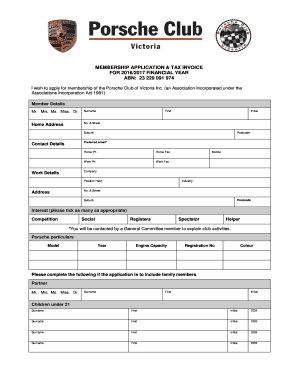

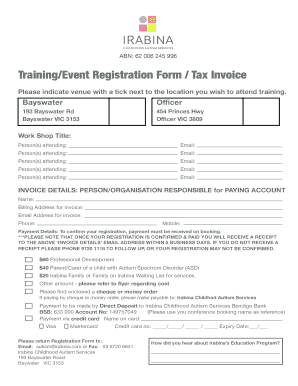

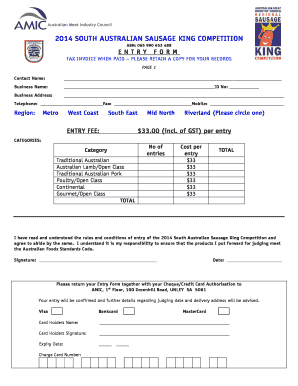

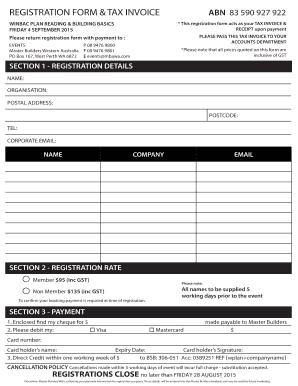

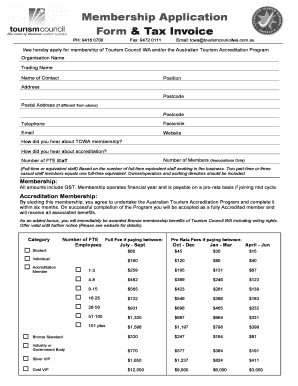

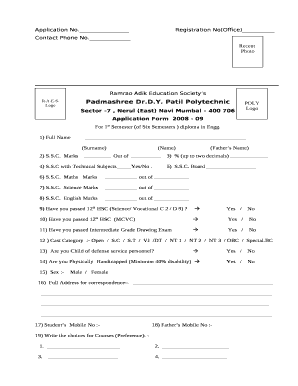

Tax Invoice Templates are pre-designed forms that help businesses create professional invoices for their products or services. These templates typically include fields for the seller's information, buyer's details, itemized list of products or services, prices, taxes, and payment terms.

What are the types of Tax Invoice Templates?

There are several types of Tax Invoice Templates available to suit different business needs. Some common types include:

Standard Invoice Template

Service Invoice Template

Retail Invoice Template

Proforma Invoice Template

Credit Memo Invoice Template

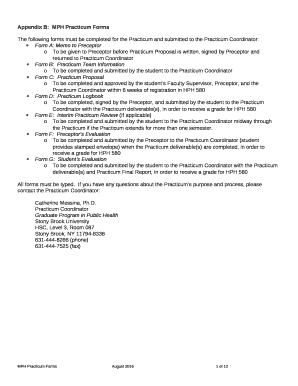

How to complete Tax Invoice Templates

Completing Tax Invoice Templates is easy and straightforward. Follow these steps to create a professional invoice using a template:

01

Enter your business information in the designated fields

02

Add the buyer's details and shipping information if applicable

03

List the products or services provided along with their prices and quantities

04

Calculate the total amount due including taxes and any discounts

05

Include payment terms and any additional notes for the buyer

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Tax Invoice Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I create a simple invoice?

How to create an invoice: A step-by-step guide Brand your invoice. Add a professional header. Include invoice information. Include the dates. Description of goods/services delivered. Include tax details and highlight the total money owed. Include payment terms. Add explanatory notes with terms and conditions.

Do you have to tax invoices?

Do you have to put tax on an invoice? Whether you need to pay taxes on an invoice will depend on what the invoice represents. If the invoice represents a bill of sale—and, as a result, is subject to sales tax—then yes, you will need to include taxes.

Can I create an invoice myself?

If you own or are a partner for more than one business, you may invoice yourself for services rendered. For example, your construction business contracts work from your house painting business — now you need an invoice to document the transaction and keep track of payments.

How is tax calculated on an invoice?

Total the taxable goods and multiply that total by the sales tax rate to determine sales tax expense for the invoice. Assume that the taxable items on the invoice total $100 --- the total sales tax fee to include on the invoice is $8 in this example.

What is difference between invoice and tax invoice?

Put very simply, an invoice is a document issued by a business that is not a vendor for VAT and a Tax Invoice is a document issued by a business that is a vendor for VAT.

How do I create a tax invoice?

What information should be included? The words “tax invoice” Invoice date and number. Customer name. Billing and shipping address. Seller business number and identity. Description of the goods and services rendered, along with the quantities and price. Tax applied to each item. Total taxes.