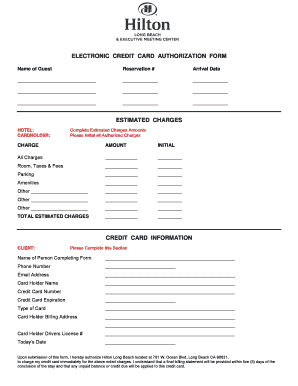

Online Credit Card Authorization Form

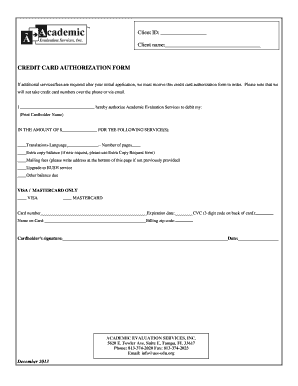

What is Online credit card authorization form?

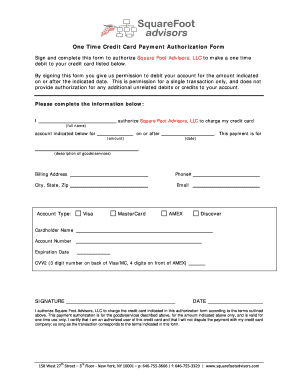

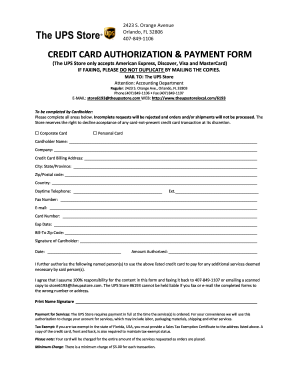

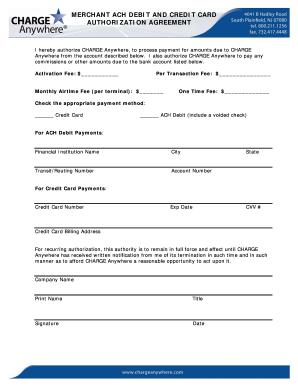

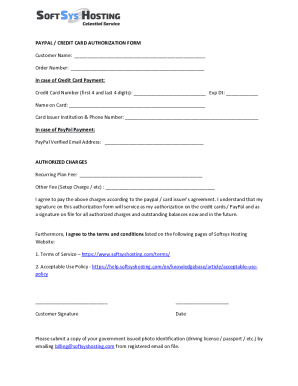

An online credit card authorization form is a digital document that allows a cardholder to provide consent for a transaction to be processed using their credit card information. It serves as a secure way for businesses to obtain permission to charge a customer's credit card for goods or services.

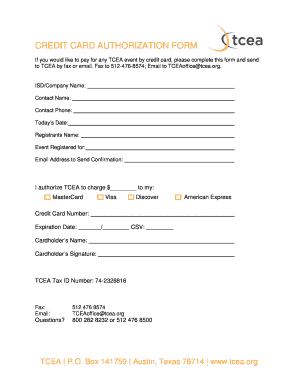

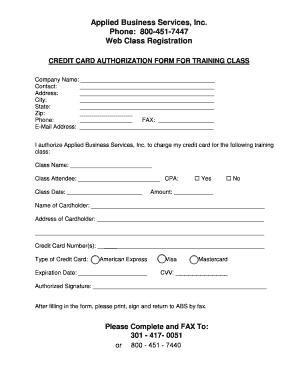

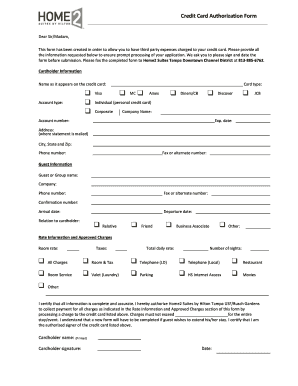

What are the types of Online credit card authorization form?

There are two main types of online credit card authorization forms: single-use and recurring. Single-use forms are used for one-time transactions, while recurring forms are utilized for ongoing payments or subscriptions.

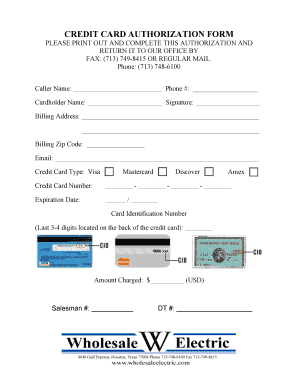

How to complete Online credit card authorization form

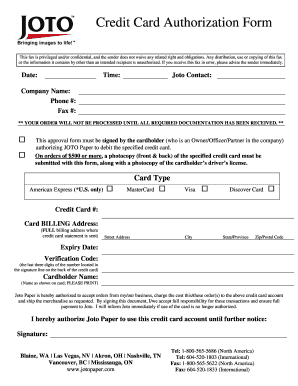

Completing an online credit card authorization form is easy and secure. Follow these simple steps to ensure your transaction is processed smoothly:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.