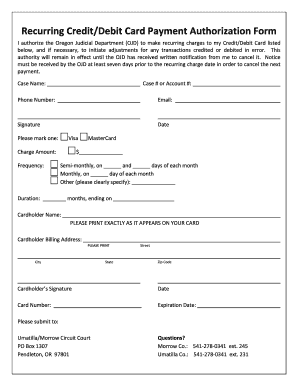

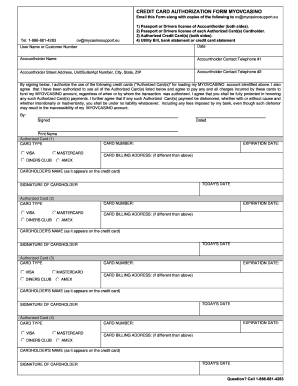

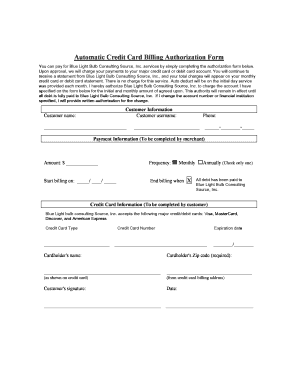

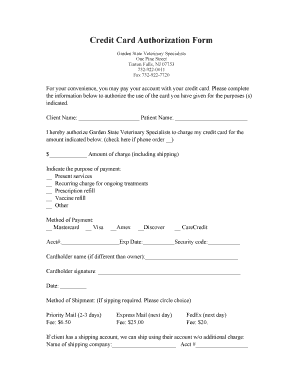

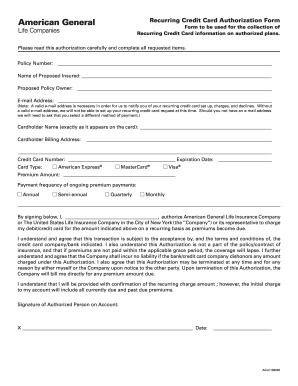

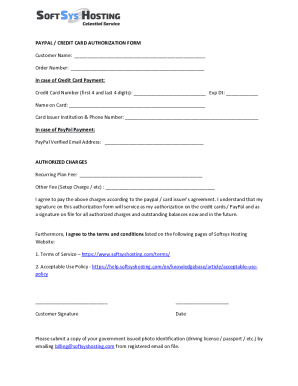

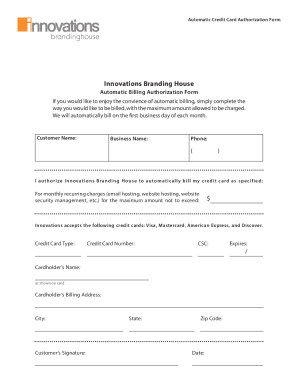

Recurring Credit Card Authorization Form Templates

What are Recurring Credit Card Authorization Form Templates?

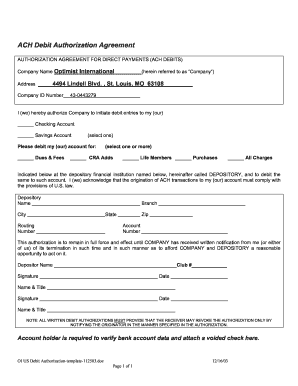

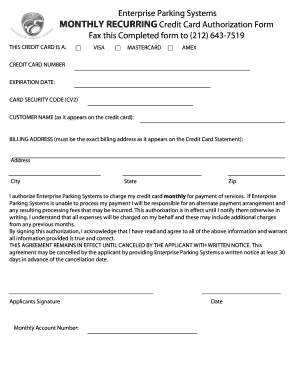

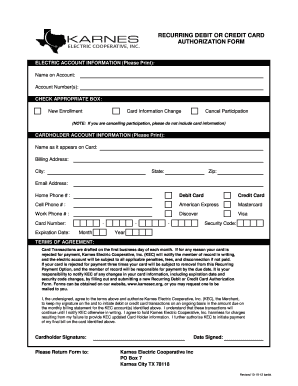

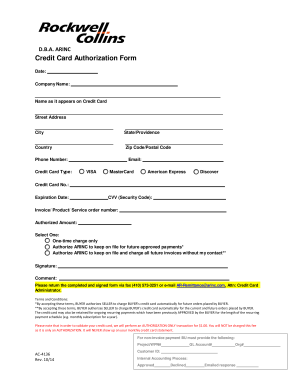

Recurring Credit Card Authorization Form Templates are standardized documents used for authorizing merchants to charge a customer's credit card on a recurring basis. These forms provide the necessary details to set up automated payments without the need for manual authorization each time.

What are the types of Recurring Credit Card Authorization Form Templates?

There are several types of Recurring Credit Card Authorization Form Templates based on the frequency of payments and the duration of the authorization. Some common types include:

How to complete Recurring Credit Card Authorization Form Templates

Completing Recurring Credit Card Authorization Form Templates is a simple process that involves filling in the required information accurately. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.