Student Loan Forgiveness Bill 2020

What is Student loan forgiveness bill 2020?

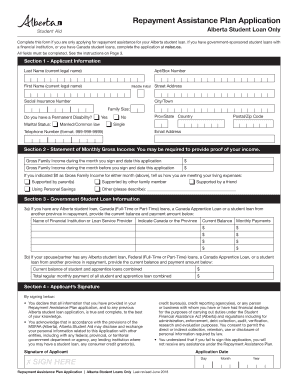

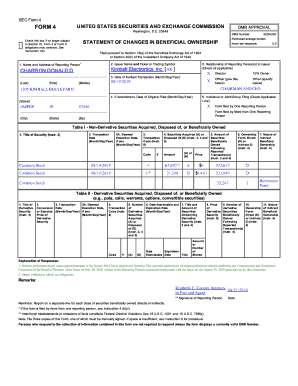

The Student loan forgiveness bill 2020 is a legislative proposal aimed at providing relief to individuals burdened by student loan debt. It seeks to alleviate the financial strain that student loans can cause and help borrowers manage their debts more effectively.

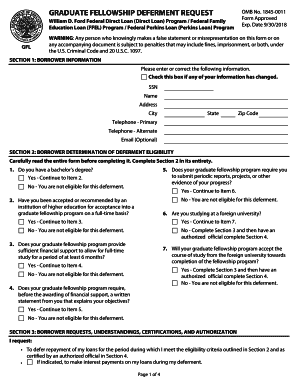

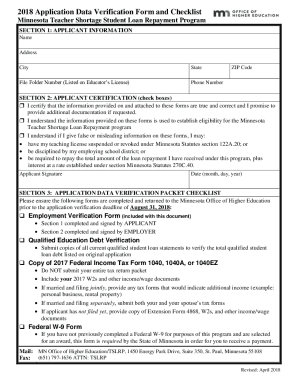

What are the types of Student loan forgiveness bill 2020?

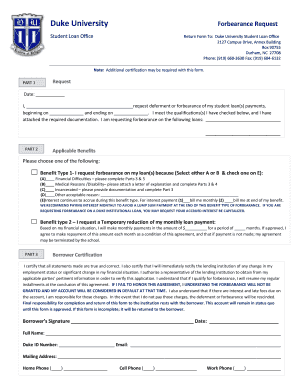

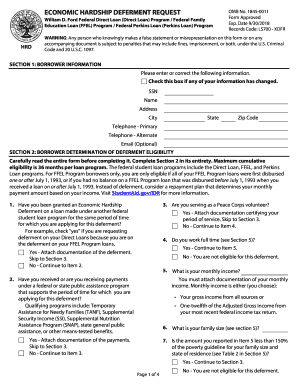

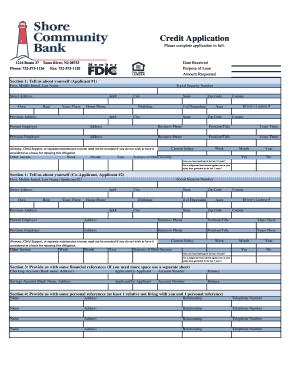

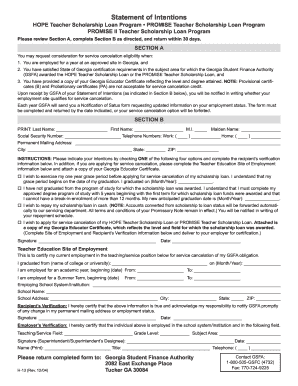

There are several types of Student loan forgiveness bill 2020 that offer different forms of relief to borrowers. These include:

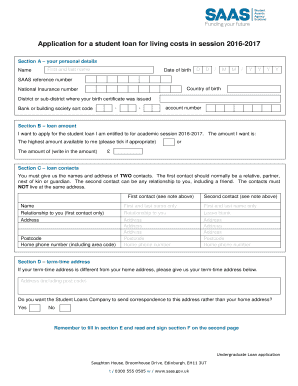

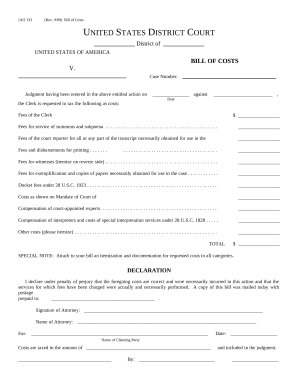

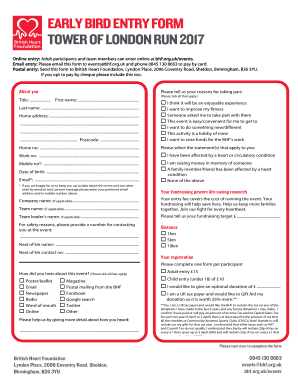

How to complete Student loan forgiveness bill 2020

Completing the Student loan forgiveness bill 2020 requires careful attention to detail and adherence to specific guidelines. To successfully navigate the process, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.