Student Loan Forgiveness Covid

What is Student loan forgiveness covid?

Student loan forgiveness covid refers to the relief programs offered to students who have been financially affected by the COVID-19 pandemic. These programs aim to lessen the burden of student loan debt during these difficult times.

What are the types of Student loan forgiveness covid?

There are several types of student loan forgiveness covid programs available to eligible individuals. Some of the common types include:

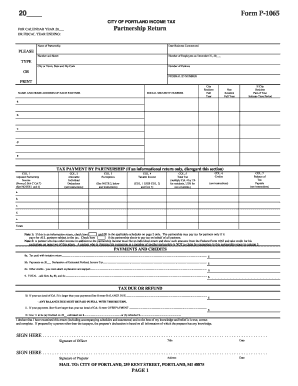

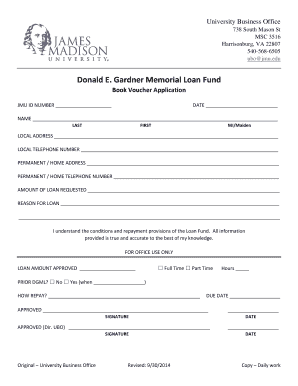

How to complete Student loan forgiveness covid

Completing student loan forgiveness covid programs may vary depending on the specific program you qualify for. However, some general steps to help you navigate the process include:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.