Sample Credit Card Application Pdf

What is Sample credit card application pdf?

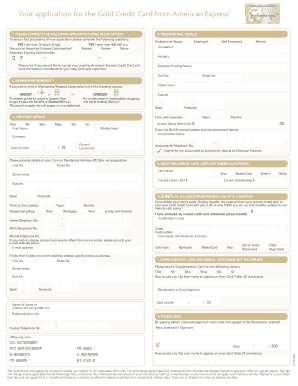

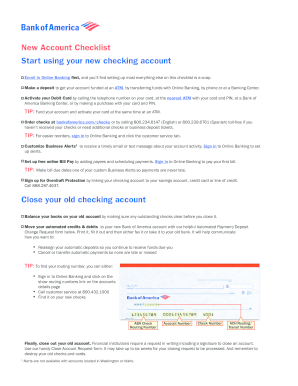

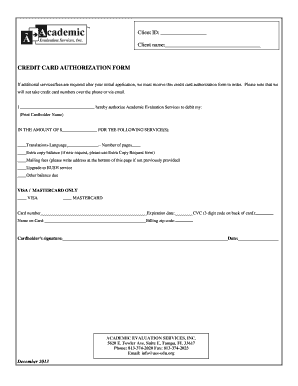

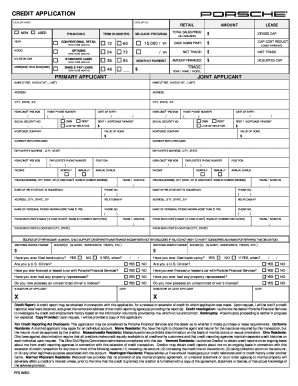

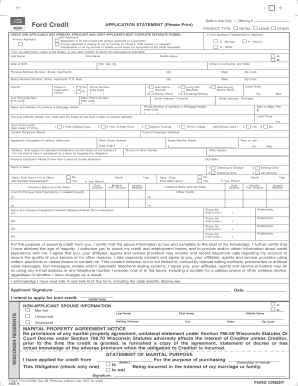

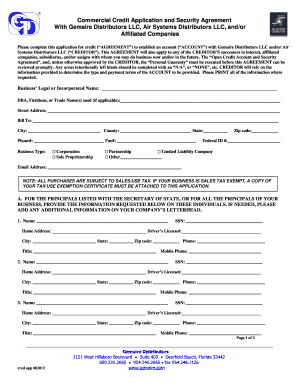

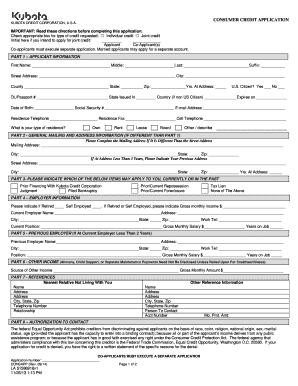

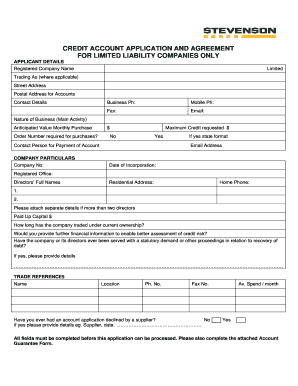

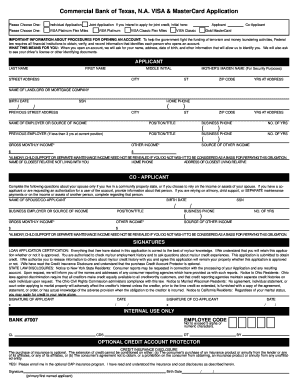

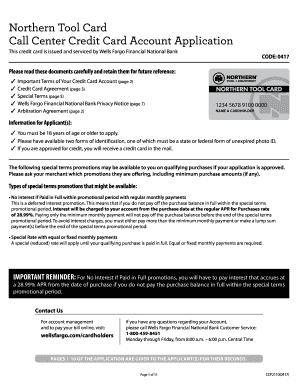

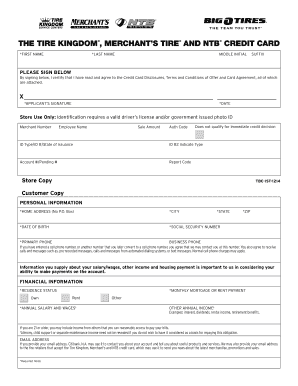

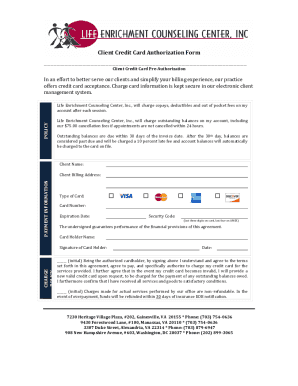

A Sample credit card application pdf is a standardized document that individuals fill out to apply for a credit card. This form typically includes personal information, financial details, and consent to a credit check.

What are the types of Sample credit card application pdf?

There are different types of Sample credit card application pdfs based on the credit card issuer and the specific card being applied for. Some common types include:

Basic credit card application pdf

Rewards credit card application pdf

Business credit card application pdf

Student credit card application pdf

How to complete Sample credit card application pdf

Completing a Sample credit card application pdf is straightforward. Here are some steps to help you fill out the form accurately and efficiently:

01

Gather all necessary documents such as identification, income proof, and other requested information.

02

Carefully read and follow instructions on the form, providing accurate and truthful information.

03

Review the completed form for any errors before submitting it.

04

Submit the filled-out Sample credit card application pdf either online or by mail as per the issuer's guidelines.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Sample credit card application pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can you get a credit card with no credit history?

Bottom line. It is possible for those with no credit history to open credit cards and earn rewards for their purchases. In general, it is easiest to qualify for secured credit cards, which require you to make a deposit in order to access a credit limit.

What are 3 things a credit card application will need?

Three things a credit card application will need are your full name, your Social Security number or Individual Taxpayer Identification Number, and information about your income. This information will help card issuers verify whether you are a real person and if you can afford making payments on a new credit card.

How to write an application for a credit card?

I humbly request you that kindly help me by making a credit card as soon as possible. By the facility of credit card I can get money from the bank easily whenever I want to, that I will pay ing to the bank policy. I will be very grateful to you.

How to make a credit card with no money?

You could open a credit card with a co-signer, which is someone who agrees to assume liability for the debt if you are unable to pay. You can also try to sign up for a joint credit card account if both you and the co-owner meet the card's approval requirements.

What credit cards do not require a deposit?

Capital One Platinum Credit Card. See Details » Capital One QuicksilverOne Cash Rewards Credit Card. Discover it® Student Cash Back. Capital One Quicksilver Student Cash Rewards Credit Card. Capital One SavorOne Student Cash Rewards Credit Card. Surge® Platinum Mastercard® Destiny Mastercard® Reflex® Platinum Mastercard®

Do you need money to start a credit card?

Credit cards that don't require a deposit are referred to as unsecured. Secured credit cards require a deposit to open an account. Secured credit cards may be a good option for people who are working to build or rebuild their credit.