Credit Application Form Template Word

What is Credit application form template word?

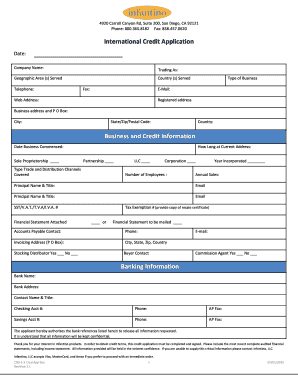

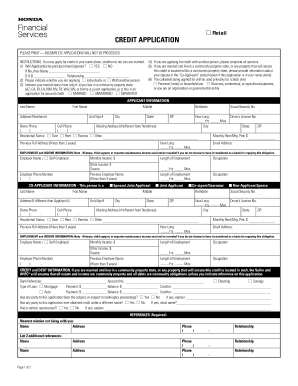

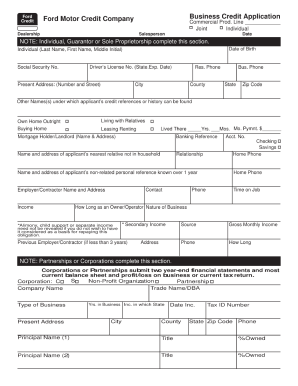

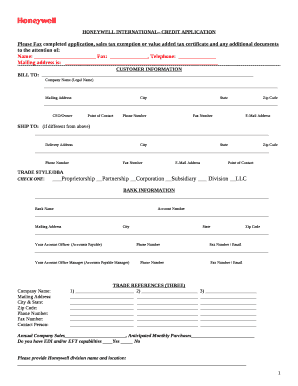

A Credit application form template word is a pre-designed document in Microsoft Word format that allows individuals or businesses to apply for credit from a financial institution. It typically includes fields for personal or business information, credit history, income details, and other relevant data required by the lender.

What are the types of Credit application form template word?

There are several types of Credit application form template word available, each designed for specific purposes. Some common types include:

How to complete Credit application form template word

Completing a Credit application form template word is a straightforward process. Here are some steps to help you fill out the form accurately:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.