Credit Check Authorization Form Canada - Page 2

What is Credit check authorization form canada?

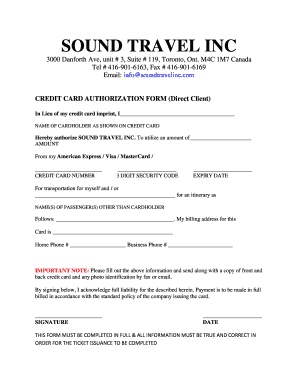

A Credit check authorization form Canada is a document that allows a third party, typically a potential lender or employer, to perform a credit check on an individual. This form grants permission for the party to access the individual's credit history and assess their financial standing.

What are the types of Credit check authorization form canada?

There are mainly two types of Credit check authorization form Canada:

Standard Credit Check Authorization Form

Limited Credit Check Authorization Form

How to complete Credit check authorization form canada

To complete a Credit check authorization form Canada, follow these simple steps:

01

Fill in your personal information accurately

02

Specify the purpose of the credit check

03

Sign and date the form to authorize the credit check

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Credit check authorization form canada

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a credit check authorization form?

A credit report authorization form is a document used to give permission to an individual or organization to perform a credit report only. This form provides broad language that allows a credit report to be generated for any type of legal reason in compliance with the Fair Credit Reporting Act (FCRA) (15 U.S.C.

Can you legally check someone else's credit score?

The short answer is no. Legally speaking, a person or organization can check your credit only under certain circumstances. Someone either needs to have what's called “permissible purpose” or have your permission and cooperation in the process for the credit check to be considered legal.

How to do a credit check on someone in Canada?

The best credit check tools for Canadian landlords SingleKey offers a simple platform that provides detailed reports using information from Equifax® credit checks. Naborly is another popular option for screening tenants, also relying on Equifax® for the bulk of its information.

Does Canada have credit reports?

The two major credit reporting bureaus are TransUnion Canada and Equifax Canada. Scores are calculated using five factors: payment history, outstanding debt, credit account history, recent inquiries and types of credit.

Can I run a credit check on someone in Canada?

To protect this information, there are laws and rules around who can access your credit report. In most cases, you must provide consent before someone can run a credit check.

What information do you need to run a credit check in Canada?

What Information Do You Need To Provide For A Credit Check? In general, lenders, employers and landlords alike can conduct a credit check using your name, address and date of birth. However, in some cases, they may request your SIN as it is an easier and more accurate way of identifying you.