Personal Financial Statement Form Templates

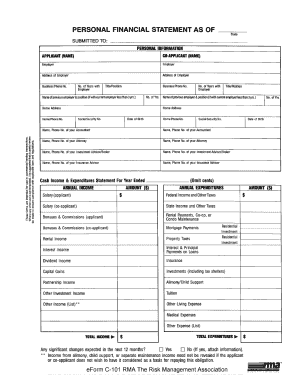

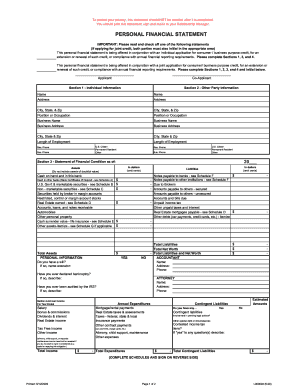

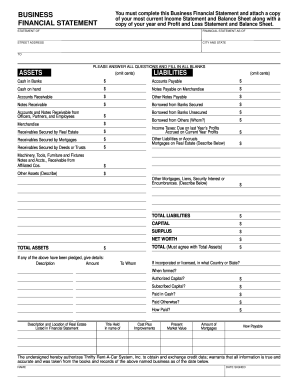

What are Personal Financial Statement Form Templates?

Personal Financial Statement Form Templates are tools that individuals can use to document their financial information, including assets, liabilities, income, and expenses. These templates help users organize their financial data in a structured format, making it easier to track and manage their finances.

What are the types of Personal Financial Statement Form Templates?

There are several types of Personal Financial Statement Form Templates available, including:

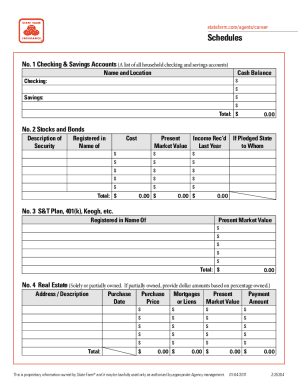

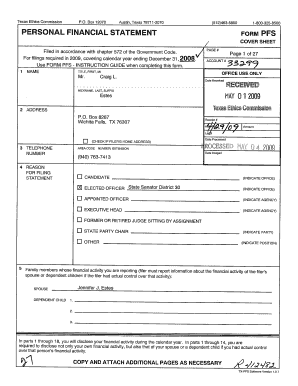

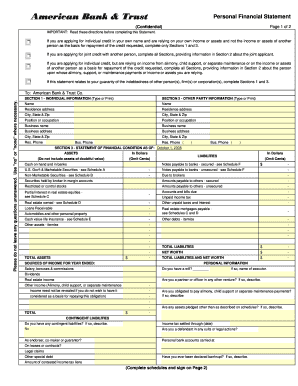

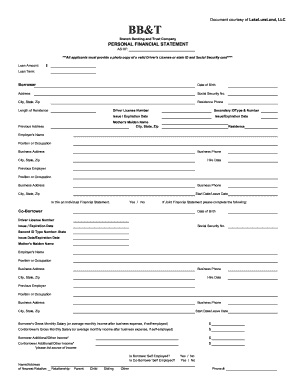

Basic Personal Financial Statement Form Template

Detailed Personal Financial Statement Form Template

Business Financial Statement Form Template

Personal Budget Template

How to complete Personal Financial Statement Form Templates

Completing Personal Financial Statement Form Templates can be done in a few simple steps:

01

Gather all your financial information, including bank statements, investment accounts, and debts.

02

Fill in the template with your financial data, ensuring accuracy and completeness.

03

Review the completed form for any errors or missing information before finalizing it.

04

Save or print the completed template for your records or share it with a financial advisor.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Personal Financial Statement Form Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What should be included in a personal financial statement?

A personal financial statement is a snapshot of your personal financial position at a specific point in time. It lists your assets (what you own), your liabilities (what you owe), and your net worth.

What is a personal financial statement template?

The term personal financial statement refers to a document or spreadsheet that outlines an individual's financial position at a given point in time. The statement typically includes general information about the individual, such as name and address, along with a breakdown of total assets and liabilities.

How do I make my own personal financial statements?

To create a personal financial statement, follow these simple steps: Create a spreadsheet that has a section for assets and one for liabilities. List your assets and their worth. List every liability as well as its worth. Determine the total of both assets and liabilities.

What are the 5 components of financial statement?

The elements of the financial statements will be assets, liabilities, net assets/equity, revenues and expenses. It is noted in Study 1 that moving along the spectrum from cash to accrual accounting does not mean a loss of the cash based information which can still be generated from an accrual accounting system.

How do you write a personal financial statement?

To create a personal financial statement, follow these simple steps: Create a spreadsheet that has a section for assets and one for liabilities. List your assets and their worth. List every liability as well as its worth. Determine the total of both assets and liabilities. Determine your net worth.

What are the two documents considered to be part of personal financial statements?

The two types of personal financial statements are the personal cash flow statement and the personal balance sheet. The personal cash flow statement measures your cash inflows (money you earn) and your cash outflows (money you spend) to determine if you have a positive or negative net cash flow.