Personal Financial Statement Template Canada

What is Personal financial statement template canada?

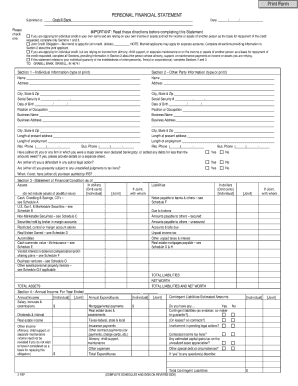

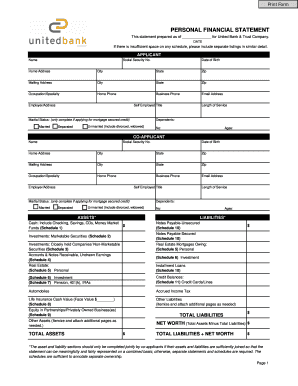

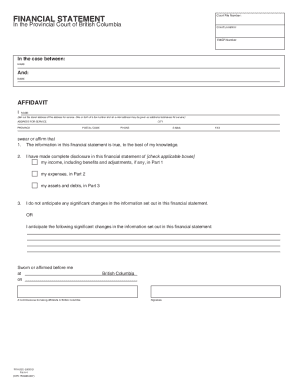

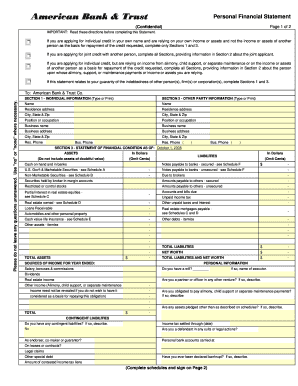

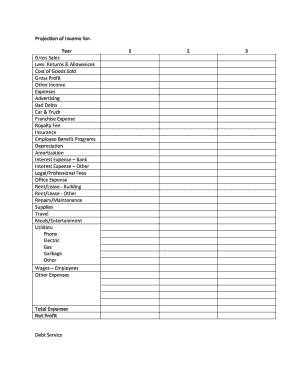

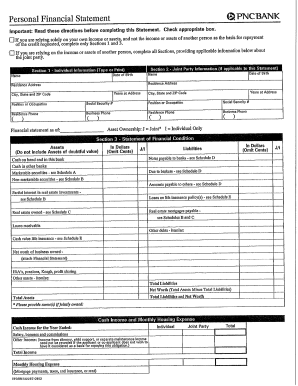

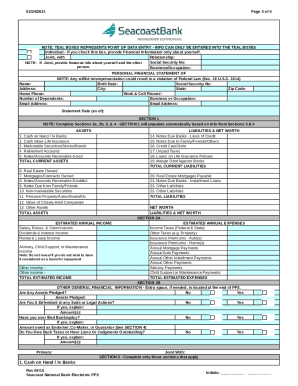

A Personal financial statement template Canada is a document that outlines an individual's financial position by listing their assets, liabilities, income, and expenses. It provides a snapshot of an individual's financial health and can be used for various purposes such as applying for loans, mortgages, or investments.

What are the types of Personal financial statement template Canada?

There are several types of Personal financial statement templates available in Canada, including: 1. Basic Personal financial statement template 2. Detailed Personal financial statement template 3. Business Personal financial statement template 4. Real estate Personal financial statement template 5. Investment Personal financial statement template

How to complete Personal financial statement template Canada

Completing a Personal financial statement template in Canada is a straightforward process. Here are the steps to follow: 1. Gather all necessary financial documents such as bank statements, investment accounts, and tax returns. 2. Fill in the template with your personal information, including your name, address, and contact details. 3. List all your assets, including cash, real estate, investments, and personal property. 4. Detail all your liabilities, such as mortgages, loans, and credit card debt. 5. Calculate your total assets and liabilities to determine your net worth. 6. Review the completed statement for accuracy and make any necessary adjustments.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.