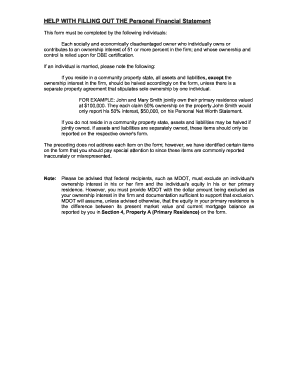

Personal Financial Statement Example Filled Out

What is Personal financial statement example filled out?

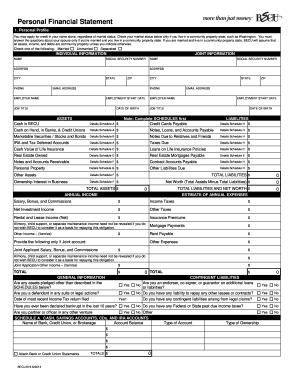

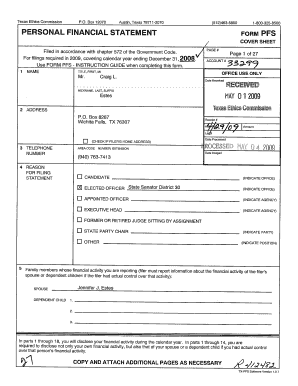

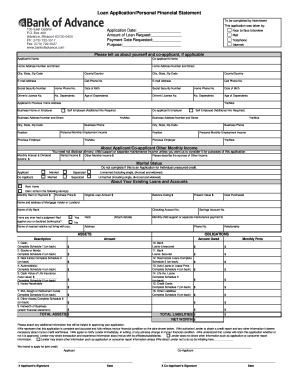

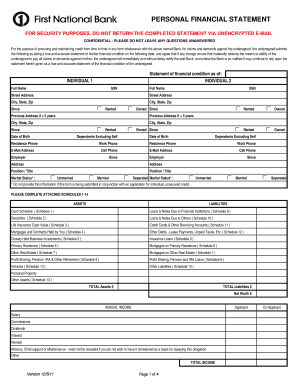

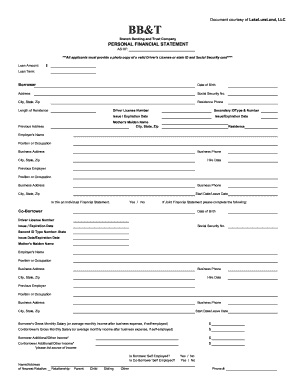

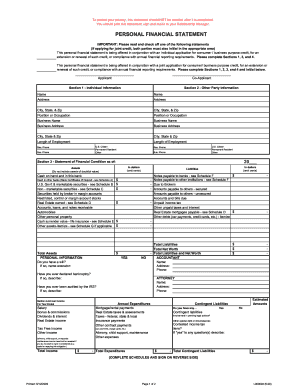

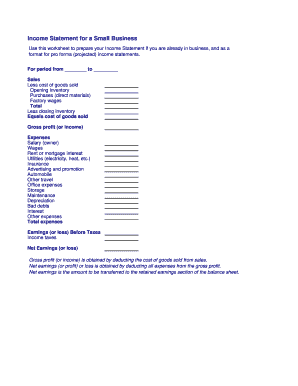

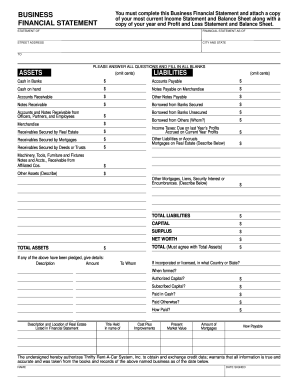

A Personal Financial Statement example filled out is a document that outlines an individual's financial situation, including assets, liabilities, income, and expenses. It helps individuals gain a clear understanding of their financial position and plan for future financial goals.

What are the types of Personal financial statement example filled out?

There are various types of Personal Financial Statement examples that individuals can fill out based on their specific financial needs. Some common types include:

How to complete Personal financial statement example filled out

Completing a Personal Financial Statement example filled out is a straightforward process that involves the following steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.