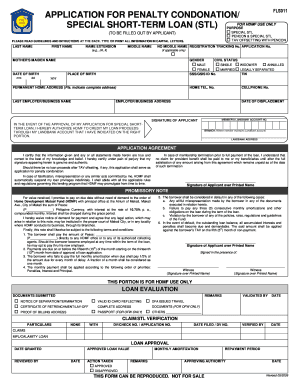

Landbank Student Loan Application Form

What is Landbank student loan application form?

The Landbank student loan application form is a document that individuals need to fill out when applying for a student loan from Landbank. This form contains personal information, financial details, and other required data for the loan application process.

What are the types of Landbank student loan application form?

There are different types of Landbank student loan application forms depending on the specific loan program. Some common types include:

Landbank Student Loan Application Form for College Students

Landbank Student Loan Application Form for Graduate Students

Landbank Student Loan Application Form for Vocational Students

How to complete Landbank student loan application form

Completing the Landbank student loan application form is a straightforward process. Follow these steps to successfully fill out the form:

01

Fill in your personal details such as name, address, contact information, and identification number.

02

Provide information about your educational background, including the name of the school or institution you are attending.

03

Indicate the loan amount you are applying for and specify the purpose of the loan.

04

Attach any required documents such as proof of enrollment, income statements, and identification.

05

Review the completed form to ensure all information is accurate and submit it to Landbank for processing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is there student loan in the Philippines?

UniFAST, SSS, GSIS, and Landbank offer student or educational loans to eligible applicants. These cover allowances and other related university expenses.

How much is student loan monthly payment?

The average monthly student loan payment is an estimated $503 based on previously recorded average payments and median average salaries among college graduates. The average borrower takes 20 years to repay their student loan debt.

How much is the student loan allowance in the Philippines?

Loanable amount: Up to ₱100,000 per school year (maximum of ₱500,000 for a five-year college degree) Interest rate: 8% per year. Loan term: 10 years with a maximum grace period of five years.

What are the requirements for LANDBANK salary loan?

What are the requirements for landbank salary loan? What are the requirements for landbank salary loan? The borrower must be 21 to 60 years old. The borrower must have a regular source of income. The borrower must have a land bank account. The borrower's net monthly income must be at least P15,000.

How much money will a student loan give me?

If you're an undergraduate, the maximum combined amount of Direct Subsidized and Direct Unsubsidized Loans you can borrow each academic year is between $5,500 and $12,500, depending on your year in school and your dependency status.

What is the benefit of student loan in the Philippines?

Advantages of Getting a Student Loan Applying for a student loan is a practical option that parents or students can consider because: 1. Personal and bank loan interest rates can reach 0.69% and even higher. Student loans can be as low as 0.50% and usually don't charge application fees.

Related templates