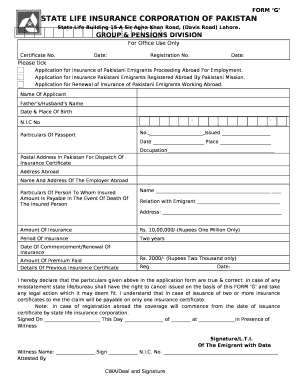

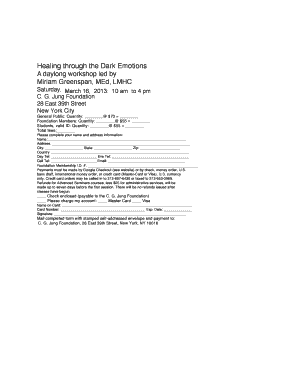

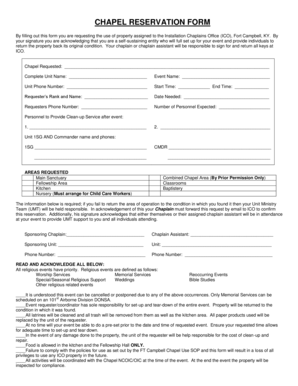

What is Life insurance form pdf?

Life insurance form pdf is a document that outlines the terms and conditions of a life insurance policy in a downloadable and printable format. It allows users to review and agree to the details of their life insurance coverage.

What are the types of Life insurance form pdf?

There are several types of Life insurance form pdf, including: 1. Term life insurance form pdf 2. Whole life insurance form pdf 3. Universal life insurance form pdf 4. Variable life insurance form pdf Each type offers different features and benefits, catering to the specific needs of policyholders.

How to complete Life insurance form pdf

Completing a Life insurance form pdf is easy with the following steps: 1. Download the form from the insurance provider's website 2. Fill in your personal details accurately 3. Review the coverage options and select the desired policy 4. Sign and date the form 5. Submit the completed form to the insurance company for processing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.