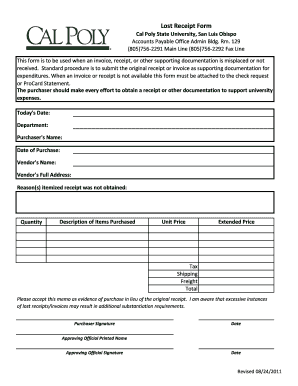

Lost Receipt Form Pdf

What is Lost receipt form pdf?

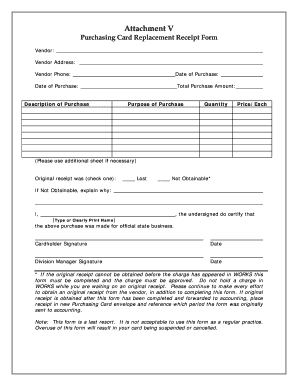

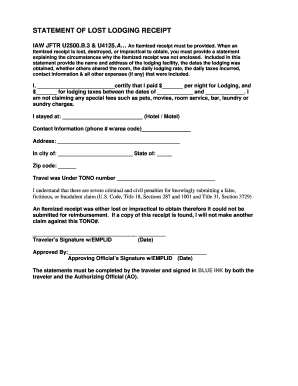

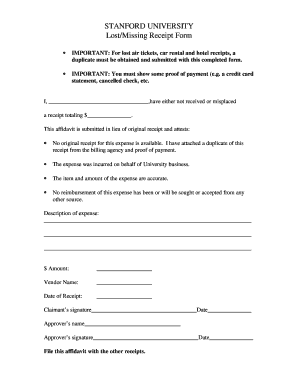

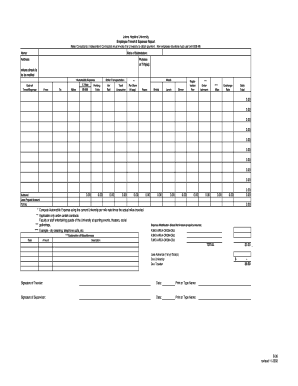

A lost receipt form PDF is a document used to report a missing or misplaced receipt. It is a convenient way to keep track of expenses even when the original receipt is no longer available.

What are the types of Lost receipt form pdf?

There are several types of lost receipt form PDFs that cater to different industries and purposes. Some common types include:

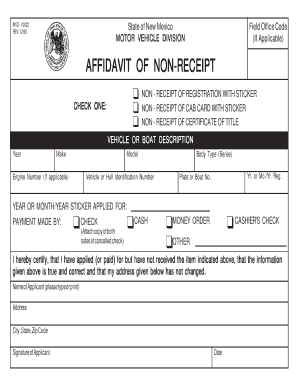

Standard Lost Receipt Form PDF

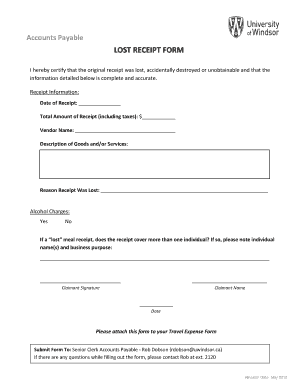

Travel Expense Lost Receipt Form PDF

Retail Purchase Lost Receipt Form PDF

Expense Report Lost Receipt Form PDF

How to complete Lost receipt form pdf

Completing a lost receipt form PDF is a simple process that involves the following steps:

01

Fill in your personal information such as name, contact details, and date

02

Provide details of the lost receipt including the amount, date of purchase, and reason for loss

03

Attach any supporting documents or information that may help in verifying the transaction

04

Sign and date the form to certify the information provided

05

Submit the completed form to the appropriate department or individual

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Lost receipt form pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is it possible to reprint a receipt?

In many cases, stores can reprint receipts for customers who have lost or misplaced them. However, that depends on the store's policy and receipt system. So it would be best to call your local store to see if reprinting receipts is possible.

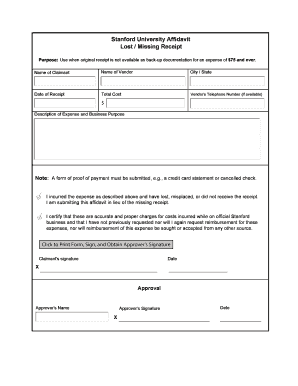

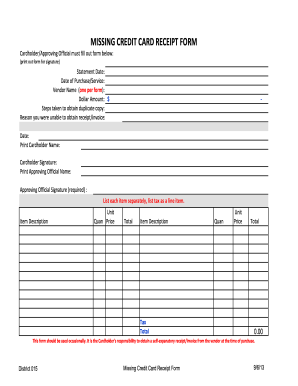

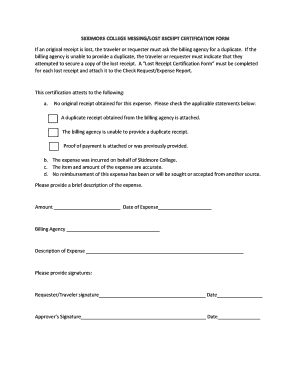

What is a missing receipt form?

The Missing Receipt Affidavit should be used when the merchant has not provided a receipt or a duplicate receipt cannot be obtained. By using the Affidavit, you are stating that the related expense is in compliance with University Policy and qualifies as a legitimate business expense.

How do I write a lost receipt?

I hereby certify that receipt(s) for the below listed items have been lost, and I am unable to obtain a copy of the receipt(s) from the issuing firm(s) (airline, travel agent, hotel, restaurant, etc.).

How do I reprint a credit card receipt?

0:23 1:39 How to reprint the last transaction receipt? - YouTube YouTube Start of suggested clip End of suggested clip And press Enter. It's the most recent transaction that you need to reprint the receipt for selectMoreAnd press Enter. It's the most recent transaction that you need to reprint the receipt for select last for the last receipt.

How long do stores keep receipts?

The general rule of thumb is to keep business receipts for as long as the IRS can audit your records. Usually, the IRS audits three years worth of records. Keep your business receipts for at least three years in case you need to show proof of purchases or sales.

What can I do if I lost my receipt?

Here's what you can do : Return to the merchant to look for the receipt. This task may not be very efficient time-wise, but it can help find the missing receipt by asking for a duplicate. Recourse to the lump sum refund. Show a bank statement. Provide a sworn statement.

Related templates