Home Insurance Form Templates - Page 5

What are Home Insurance Form Templates?

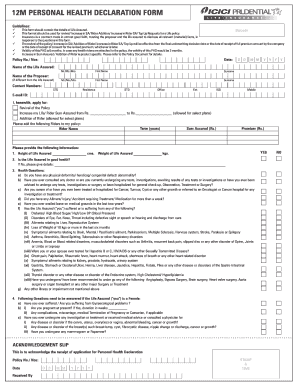

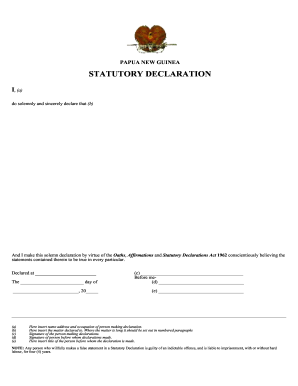

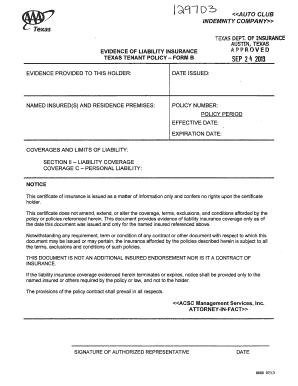

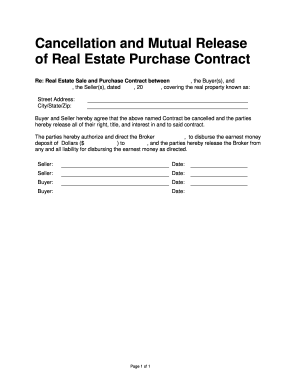

Home Insurance Form Templates are pre-designed documents that provide a framework for homeowners to fill out essential information regarding their insurance coverage. These templates can save time and ensure all necessary details are included in the insurance forms.

What are the types of Home Insurance Form Templates?

There are several types of Home Insurance Form Templates available, including:

Property Insurance Templates

Liability Insurance Templates

Homeowner Policy Templates

Renter's Insurance Templates

How to complete Home Insurance Form Templates

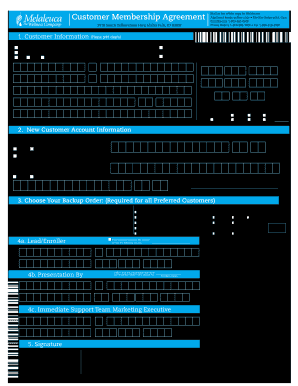

Completing Home Insurance Form Templates is a straightforward process. Follow these steps:

01

Fill in personal details like name, address, and contact information

02

Provide details about the property being insured

03

Specify the coverage requirements and limits

04

Review the completed form for accuracy

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Home Insurance Form Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are 2 examples each of commonly covered and not covered homeowners insurance situations?

Damage or destruction due to vandalism, fire and certain natural disasters are all usually covered. So is your liability if someone is injured on your property. Certain catastrophes, like flooding or earthquakes, are generally not covered by basic homeowners policies and require specialized insurance.

What are four things not covered by homeowners insurance?

Standard homeowners insurance policies typically do not include coverage for valuable jewelry, artwork, other collectibles, identity theft protection, or damage caused by an earthquake or a flood.

What is the most common homeowners insurance form?

The HO-3, also known as a "special form," is the most common homeowners insurance policy form, says the National Association of Insurance Commissioners. An HO-3 offers "open peril" coverage for the structure of your home.

What are the six categories typically covered by homeowners insurance?

Generally, a homeowners insurance policy includes at least six different coverage parts. The names of the parts may vary by insurance company, but they typically are referred to as Dwelling, Other Structures, Personal Property, Loss of Use, Personal Liability and Medical Payments coverages.

What are 2 things not covered in homeowners insurance?

Many things that aren't covered under your standard policy typically result from neglect and a failure to properly maintain the property. Termites and insect damage, bird or rodent damage, rust, rot, mold, and general wear and tear are not covered.

Which two are not covered by homeowners insurance?

Standard homeowners insurance does NOT cover damage caused by flooding, earthquakes, termites, mold, or normal wear and tear. Learn about all the different home insurance exclusions and how to get covered.