Certificate Insurance Request Form Templates

What are Certificate Insurance Request Form Templates?

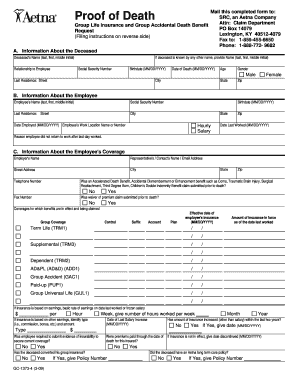

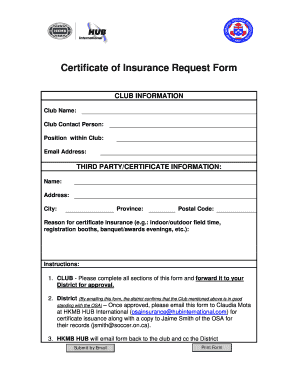

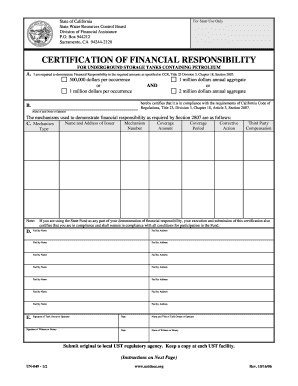

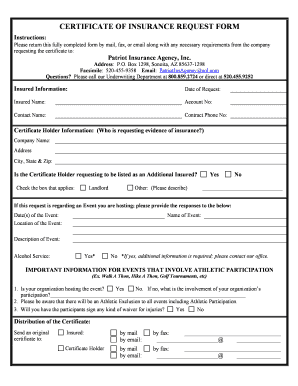

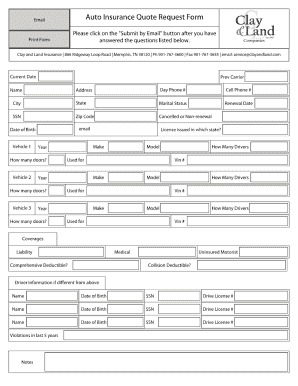

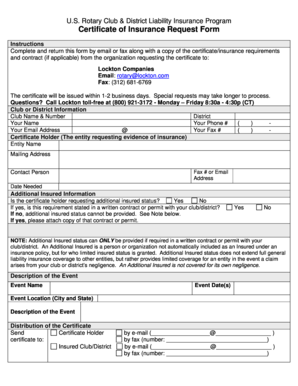

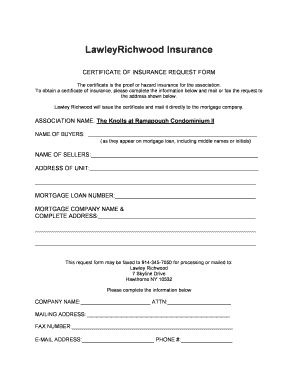

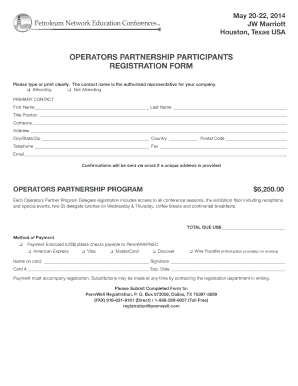

Certificate Insurance Request Form Templates are standardized forms used to request proof of insurance coverage from an insurance provider. These forms are often required by businesses or individuals to demonstrate that they have adequate insurance for specific purposes, such as for a contract or event.

What are the types of Certificate Insurance Request Form Templates?

There are several types of Certificate Insurance Request Form Templates available, including but not limited to: 1. General Liability Insurance Certificate Request Form 2. Auto Insurance Certificate Request Form 3. Workers' Compensation Insurance Certificate Request Form 4. Property Insurance Certificate Request Form

How to complete Certificate Insurance Request Form Templates

Completing Certificate Insurance Request Form Templates is a straightforward process. Follow these steps to ensure you fill out the form correctly: 1. Provide your personal or business information as required. 2. Specify the type of insurance coverage needed. 3. Include any relevant details or additional information requested. 4. Sign and date the form to certify its accuracy and authenticity.

pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. pdfFiller is the only PDF editor users need to get their documents done efficiently and effectively.