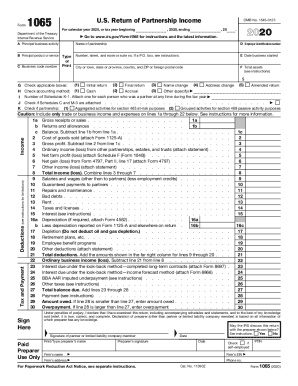

2019 Business Tax Return Form - Page 2

What is 2019 business tax return form?

The 2019 business tax return form is a document that business owners need to file with the IRS to report their income, deductions, and other financial information related to their business operations for the year 2019.

What are the types of 2019 business tax return form?

There are several types of 2019 business tax return forms based on the type of business entity. Some of the common forms include:

Form 1065 - Partnerships

Form 1120 - Corporations

Form 1120-S - S Corporations

Form 1040 - Sole Proprietorships

How to complete 2019 business tax return form

To successfully complete your 2019 business tax return form, follow these steps:

01

Gather all necessary financial documents such as income statements, expense receipts, and depreciation schedules.

02

Fill out the applicable sections of the form accurately and completely.

03

Double-check all calculations and ensure all information is correct.

04

Submit the form by the deadline to avoid any penalties.

05

Consider using pdfFiller for an efficient and streamlined process. pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. It is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 2019 business tax return form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Does an LLC file as C corp or S corp?

To elect to be taxed as an S corporation, you simply file an IRS Form 2553 with the IRS after you have formed your LLC. If you want to be taxed as a C corporation, you simply file an IRS Form 8832 with the IRS after you have formed your LLC.

What is the difference between 1120 and 1120S?

C corporations use Form 1120 to calculate their taxes due. S corporations use Form 1120S as an information return. S corporations must also prepare a form 10 K-1 for each shareholder to include with their individual returns.

Is form 1120 for LLC?

Limited liability companies (LLCs). LLCs only file Form 1120 if they've elected to be taxed as a corporation. Partnership LLCs file Form 1065 instead and single-member LLCs usually file their taxes via the owner's personal federal tax return.

How do I get a copy of my 2019 business tax return?

Use Form 4506, Request for Copy of Tax Return, to request copies of tax returns. Automated transcript request. You can quickly request transcripts by using our automated self-help service tools. Please visit us at IRS.gov and click on “Order a Return or Account Transcript” or call 1-800-908-9946.

Is an LLC a 1120 or 1120S?

Corporate Filing Requirements The LLC will report all income and deductions on Form 1120 annually and pay the appropriate amount.

Is an LLC filing as an S corp the same as an S corp?

An LLC is a legal business structure while S corporation is a tax classification that's available to some small businesses. Both LLCs and corporations can elect S-corp taxation by filing a form with the IRS. When starting a business, it's important to evaluate your options from both a legal and a tax perspective.