Wage Garnishment Laws By State

What is Wage garnishment laws by state?

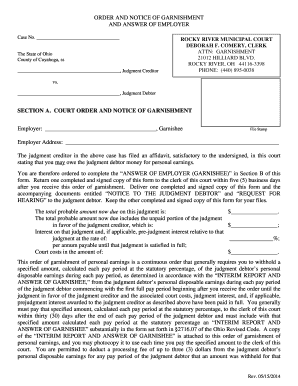

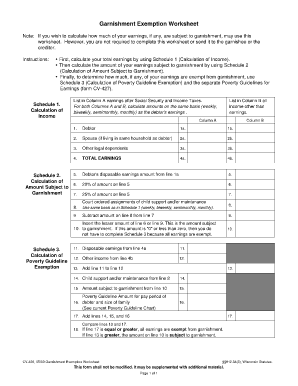

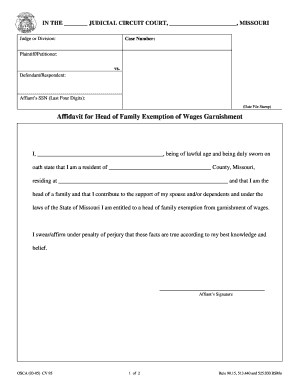

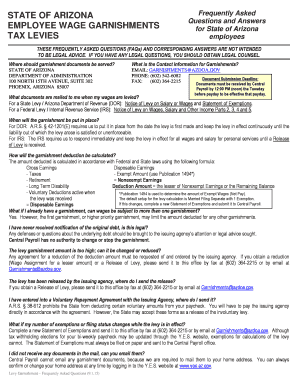

Wage garnishment laws by state refer to the regulations set in each state concerning the process of legally deducting a portion of an employee's wages for the payment of debts. These laws vary from state to state and cover aspects such as the maximum percentage of wages that can be garnished, the types of debts that qualify for garnishment, and the procedures that must be followed by employers and creditors.

What are the types of Wage garnishment laws by state?

There are several types of wage garnishment laws by state, including:

How to complete Wage garnishment laws by state

To ensure compliance with wage garnishment laws in your state, follow these steps:

pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. It is the only PDF editor users need to get their documents done efficiently and effectively.