Payroll Garnishment Rules

What is Payroll garnishment rules?

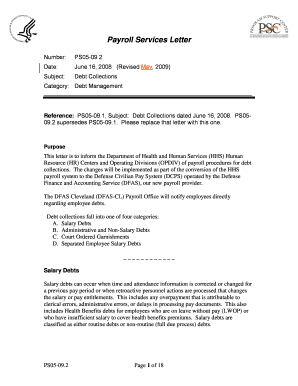

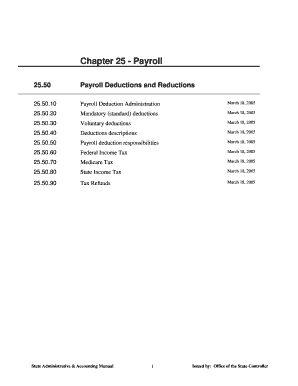

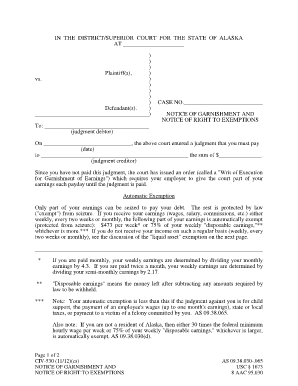

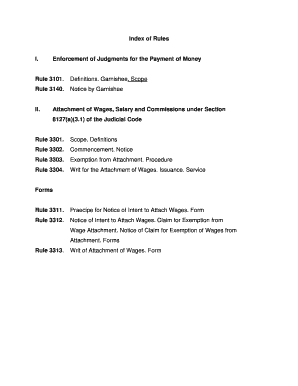

Payroll garnishment rules are regulations that govern the process by which a portion of an employee's earnings are withheld by their employer to satisfy a debt or obligation. These rules are designed to ensure that garnishments are handled fairly and in accordance with state and federal laws.

What are the types of Payroll garnishment rules?

There are several types of Payroll garnishment rules, including:

Wage garnishment for child support

Wage garnishment for spousal support

Wage garnishment for unpaid taxes

Wage garnishment for consumer debts

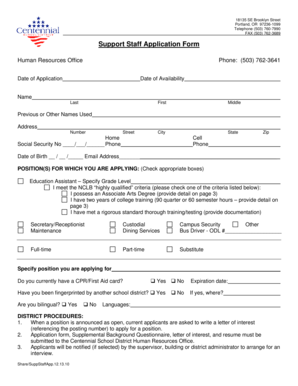

How to complete Payroll garnishment rules

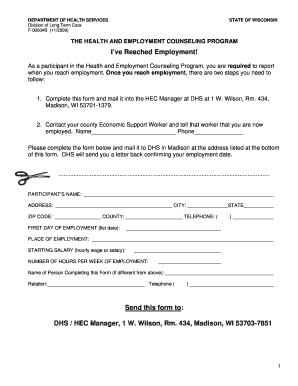

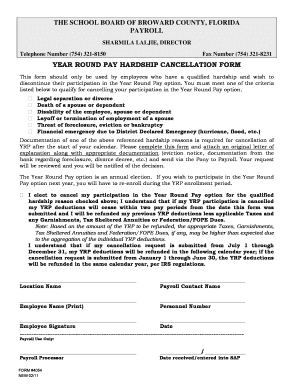

To successfully complete Payroll garnishment rules, follow these steps:

01

Determine the type of garnishment required by law

02

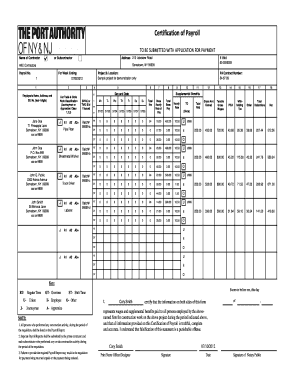

Calculate the correct amount to be withheld from the employee's paycheck

03

Ensure that the garnishment is processed accurately and in a timely manner

04

Communicate with the employee about the garnishment and answer any questions they may have

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Payroll garnishment rules

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the most common type of garnishment?

Types of wage garnishment Child support is the most common wage garnishment in the United States, but it's not the only reason an employer may receive a garnishment order. Other examples include: Creditor garnishments.

How does a garnishment affect your credit score?

Wage Garnishment Isn't Included on Your Credit Report Since your wages are likely being garnished as a result of having missed payments on one or more debts, your credit may have been dinged, but it was the missed payments that hurt your score.

What is the law for garnishment in Indiana?

Limits on Wage Garnishment in Indiana For any given workweek, creditors are allowed to garnish the lesser of: 25% of your disposable earnings, or. the amount by which your weekly disposable earnings exceed 30 times the federal hourly minimum wage.

How long does a garnishment affect your credit?

A garnishment judgment will stay on your credit reports for up to seven years, affecting your credit score. But there are a few easy ways to bolster your credit, both during and after wage garnishment.

What is the most wages can be garnished?

Federal Wage Garnishment Limits for Judgment Creditors If a judgment creditor is garnishing your wages, federal law provides that it can take no more than: 25% of your disposable income, or. the amount that your income exceeds 30 times the federal minimum wage, whichever is less.

How do I remove a garnishment from my credit report?

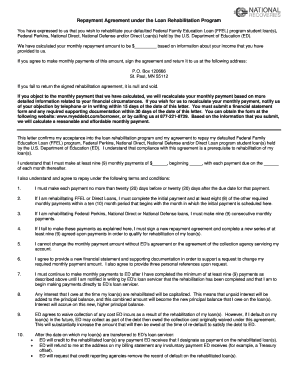

If a court has awarded judgment to your creditor and garnishment is part of the plan, here are some potential ways to get rid of it. Pay Off the Debt. Work With Your Creditor. Challenge the Garnishment. File a Claim of Exemption. File for Bankruptcy.