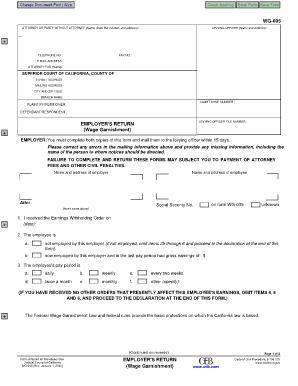

Employer Wage Garnishment Guidelines

What is Employer wage garnishment guidelines?

Employer wage garnishment guidelines refer to the rules and regulations that dictate how much money can be withheld from an employee's paycheck to pay off debts or fulfill other financial obligations.

What are the types of Employer wage garnishment guidelines?

There are several types of Employer wage garnishment guidelines, including:

Federal wage garnishment guidelines

State-specific wage garnishment guidelines

Court-ordered wage garnishment guidelines

How to complete Employer wage garnishment guidelines

To successfully complete Employer wage garnishment guidelines, follow these steps:

01

Review the employee's debt and the applicable guidelines

02

Calculate the maximum amount that can be garnished from the employee's paycheck

03

Withhold the specified amount from the employee's wages

04

Submit the garnished amount to the appropriate entity or creditor

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

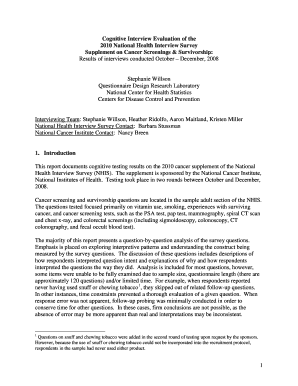

Video Tutorial How to Fill Out Employer wage garnishment guidelines

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is there a way around wage garnishment?

Act quickly to prevent wage garnishment You can file a Claim of Exemption any time after wage garnishment has started, but you'll only get wages back from the time after you submit the claim. If you act quickly, you can stop it before it even starts. By law, your employer cannot fire you for a single wage garnishment.

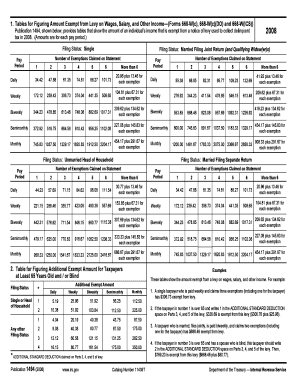

What is the most wages can be garnished?

Federal Wage Garnishment Limits for Judgment Creditors If a judgment creditor is garnishing your wages, federal law provides that it can take no more than: 25% of your disposable income, or. the amount that your income exceeds 30 times the federal minimum wage, whichever is less.

How much can be garnished from bank account in Nebraska?

Every person in Nebraska is entitled to protect up to $5,000 of any personal property--including funds on deposit with a bank--under Nebraska Statute 25-1552.

What is the statute 25 1558 in Nebraska?

25-1558. Wages. subject to garnishment. amount. exceptions. (c) Fifteen percent of his or her disposable earnings for that week, if the individual is a head of a family. (c) Any debt due for any state or federal tax. (3) No court shall make, execute, or enforce any order or process in violation of this section.

How do garnishments work in Nebraska?

In the state of Nebraska your income may be garnished up to 25% if you are NOT the head of a household (no dependents and/or not the highest wage-earner). This means you could lose $250 of every $1000 you make. Even if you are the head of your household you may still be garnished up to 15%.

What are the garnishment laws in Nebraska?

In Nebraska, for any workweek, a creditor may garnish the lesser of: 25% of your disposable earnings, or 15% of your disposable earnings if you're the head of a family, or. the amount by which your weekly disposable earnings exceed 30 times the federal hourly minimum wage.