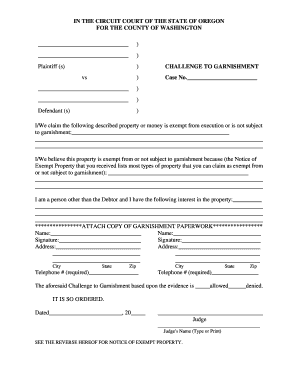

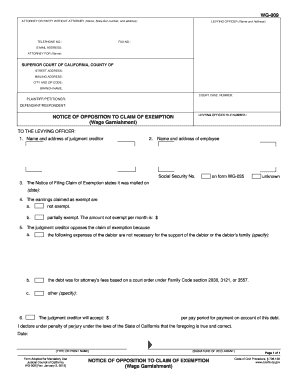

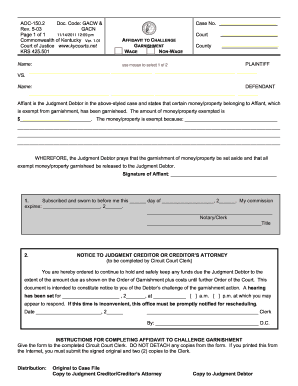

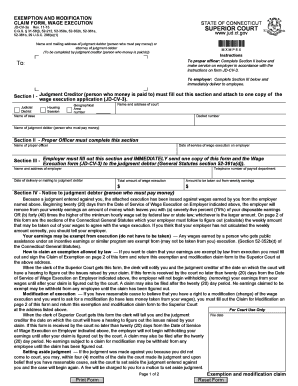

Wage Garnishment Exemption

What is Wage garnishment exemption?

Wage garnishment exemption is a legal process that protects a portion of your earnings from being taken by creditors through wage garnishment. This allows you to maintain a certain level of financial stability while still addressing your outstanding debts.

What are the types of Wage garnishment exemption?

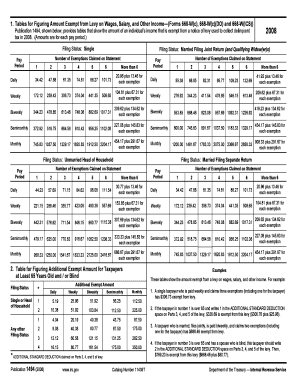

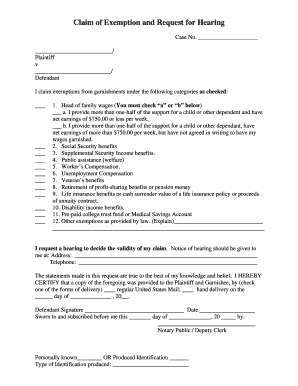

There are several types of wage garnishment exemptions that vary depending on your state laws. Some common types include head of household exemption, low-income exemption, and minimum weekly exempt amounts.

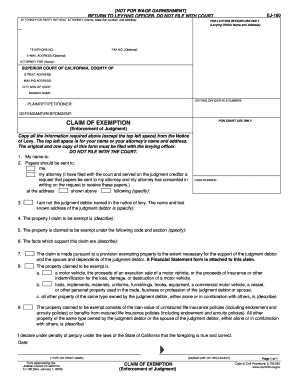

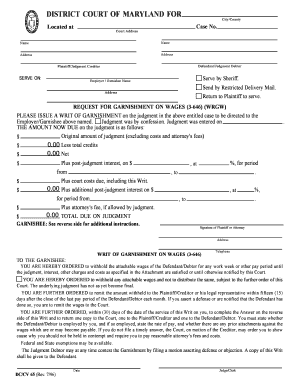

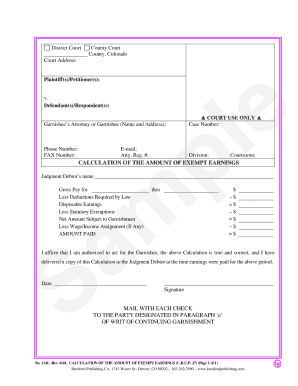

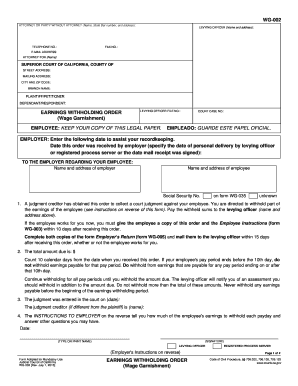

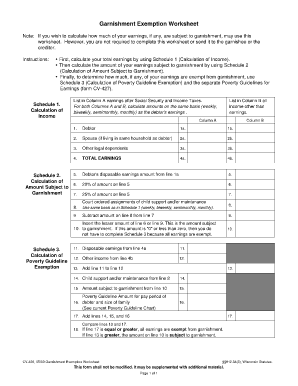

How to complete Wage garnishment exemption

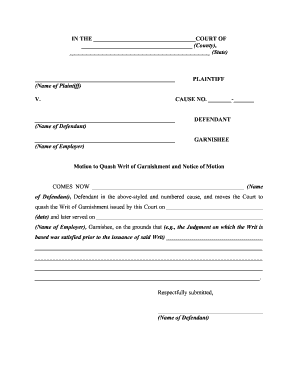

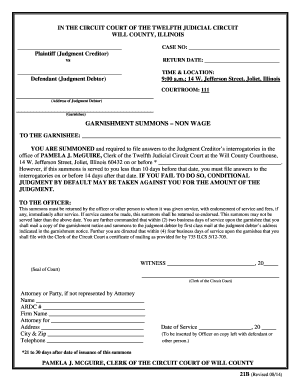

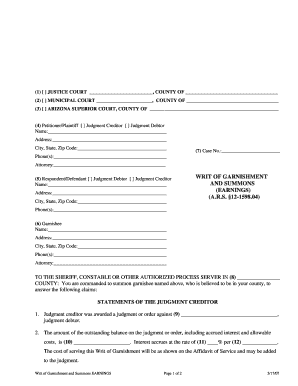

Completing a wage garnishment exemption requires careful attention to detail and adherence to the specific guidelines set forth by your state. Here are some steps to help you navigate the process:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.