Cobra Notice Requirements - Page 2

What is Cobra notice requirements?

When it comes to Cobra notice requirements, it refers to the regulations that mandate employers to provide their employees with information about their rights to continue health insurance coverage after they experience a qualifying event such as termination of employment.

What are the types of Cobra notice requirements?

There are generally three types of Cobra notice requirements that employers need to be aware of: Initial Notice, Qualifying Event Notice, and Election Notice.

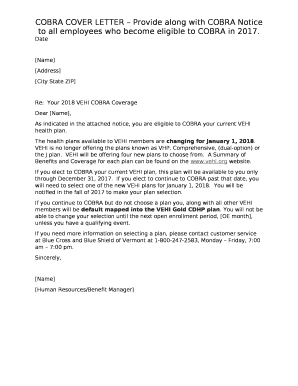

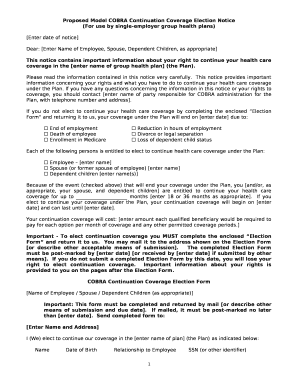

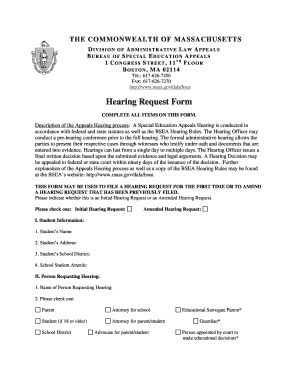

Initial Notice - This notice must be provided to employees and their dependents when they first become eligible for Cobra coverage.

Qualifying Event Notice - Employers must notify their plan administrator within 30 days of a qualifying event occurring.

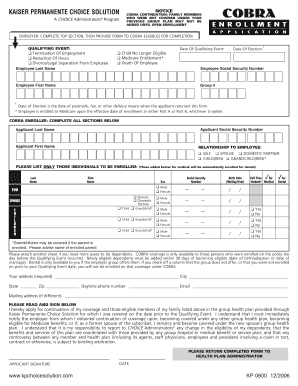

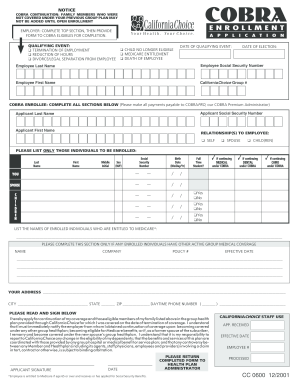

Election Notice - After receiving a Qualifying Event Notice, employees have 60 days to elect for Cobra coverage.

How to complete Cobra notice requirements

To ensure compliance with Cobra notice requirements, follow these steps:

01

Determine eligibility criteria for Cobra coverage

02

Issue Initial Notice to eligible employees and dependents

03

Provide Qualifying Event Notice to plan administrator within 30 days of the event

04

Issue Election Notice to employees within 14 days of receiving Qualifying Event Notice

05

Keep detailed records of all Cobra notifications sent

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Cobra notice requirements

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What if my employer never sent COBRA information?

If your employer fails to notify the plan, you can contact the Department of Labor (DOL). The DOL fines companies that do not provide COBRA information within the proper time limits. You can also contact the benefits administrator at your previous company to ensure you receive the COBRA paperwork in time.

Can COBRA notices be sent electronically?

Early COBRA termination Delivery method: First-class mail or electronic delivery to employee and spouse, or hand-delivered if employee only.

What is the COBRA initial notice?

This notice is intended to provide a summary of your rights, options, and notification responsibilities under COBRA. Should an actual qualifying event occur in the future and coverage is lost, the CalPERS will provide you (and your covered dependents, if any), with the appropriate COBRA election notice at that time.

What penalties are available if an employer fails to comply with COBRA?

Plans that violate COBRA's provisions may be subject to a non-deductible excise tax penalty equal to $100 per day, per affected individual, per violation. In addition, ERISA provides notice penalties of up to $110 per day from the date of the compliance failure.

When should I expect COBRA paperwork?

Your employer must mail you the COBRA information and forms within 14 days after receiving notification of the qualifying event.

What is the penalty for not offering COBRA?

The employer penalties for not complying with the COBRA: The IRS can charge you $100 tax per day of noncompliance per person or $200 tax per day per family.