Cobra Insurance

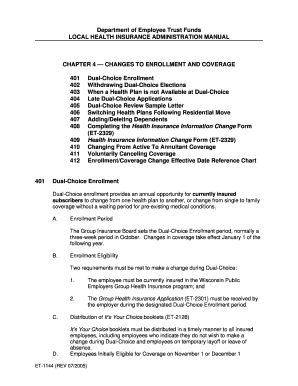

What is Cobra insurance?

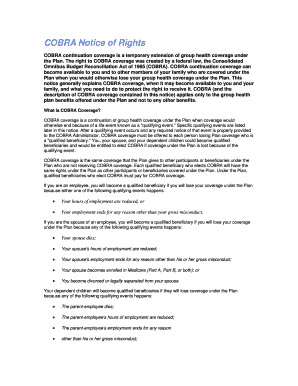

Cobra insurance is a federal law that allows employees to continue their employer-sponsored health insurance coverage for a certain period of time after leaving their job.

What are the types of Cobra insurance?

There are three main types of Cobra insurance: individual coverage, family coverage, and Medicare extension coverage.

Individual coverage

Family coverage

Medicare extension coverage

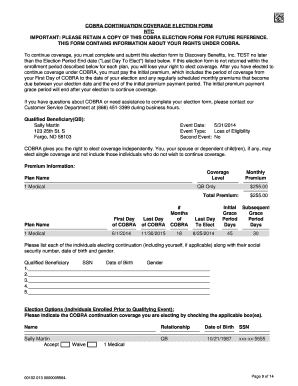

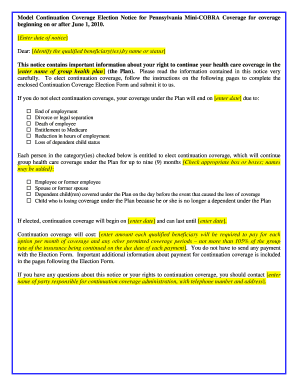

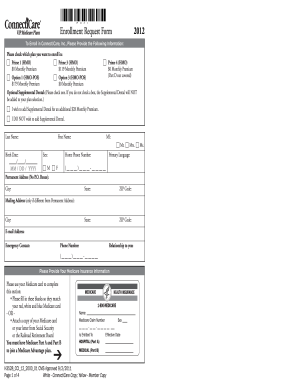

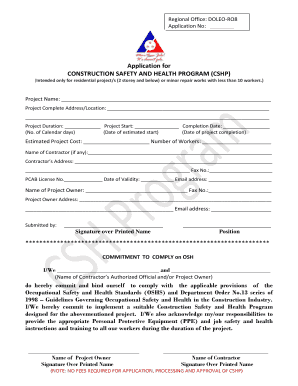

How to complete Cobra insurance

Completing Cobra insurance is a simple process that involves notifying your employer of your desire to continue coverage, filling out the necessary paperwork, and paying the required premiums.

01

Notify your employer of your desire to continue coverage

02

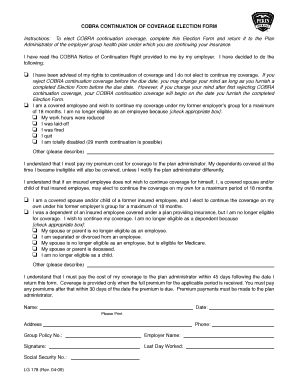

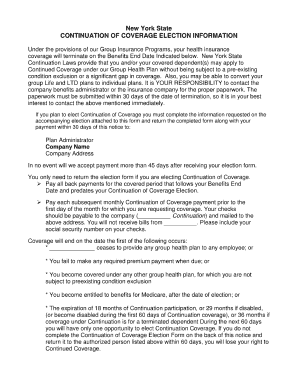

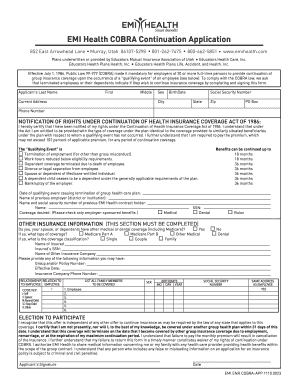

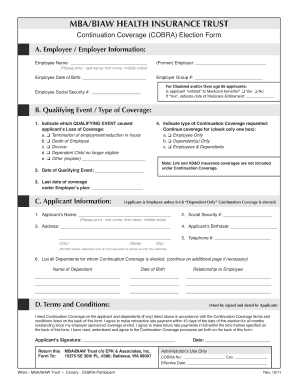

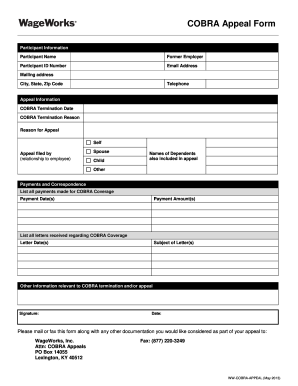

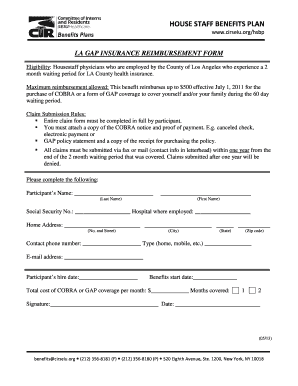

Fill out the necessary paperwork

03

Pay the required premiums

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Cobra insurance

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is COBRA insurance and how does it work?

COBRA stands for the Consolidated Omnibus Budget Reconciliation Act. COBRA allows former employees, retirees, and their dependents to temporarily keep their health coverage. If you get COBRA, you must pay for the entire premium, including any portion that your employer may have paid in the past.

How long does it take for COBRA to kick in?

Assuming one pays all required premiums, COBRA coverage starts on the date of the qualifying event, and the length of the period of COBRA coverage will depend on the type of qualifying event which caused the qualified beneficiary to lose group health plan coverage.

Will COBRA cover me retroactively?

Yes, COBRA is retroactive. If you initially choose not to opt in for COBRA insurance, you can still opt for coverage later. However, retroactive benefits mean that if you opt in for COBRA coverage, the start date is the day after you lost your employer's insurance.

How long after quitting can you get COBRA?

You have 60 days from a “qualifying event” or the date your notice is mailed, whichever is later, to enroll in COBRA. A qualifying life event can be a job loss, divorce or death of your spouse, among others. Your former employer will send you details about how to sign up.

How does COBRA work after leaving job?

You may be able to keep your job-based health plan through COBRA continuation coverage. COBRA coverage lets you pay to stay on your job-based health insurance for a limited time after your job ends (usually 18 months). You usually pay the full premium yourself, plus a small administrative fee.

How does COBRA work when you quit?

COBRA coverage lets you pay to stay on your job-based health insurance for a limited time after your job ends (usually 18 months). You usually pay the full premium yourself, plus a small administrative fee.