Garnishment Policy Templates - Page 2

What are Garnishment Policy Templates?

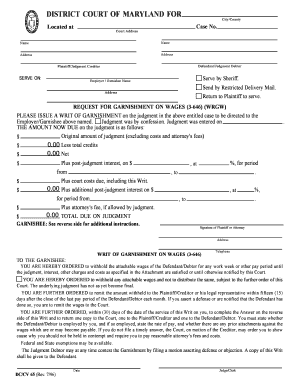

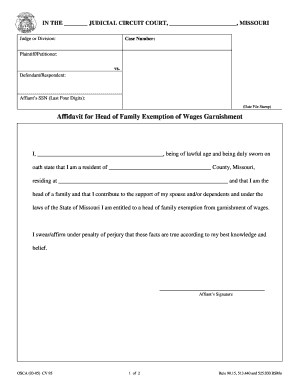

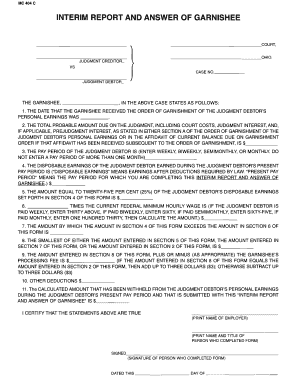

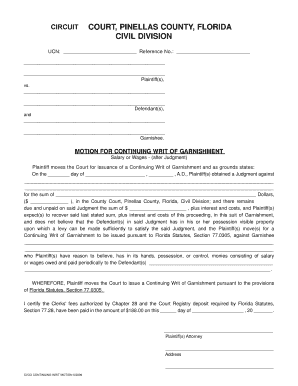

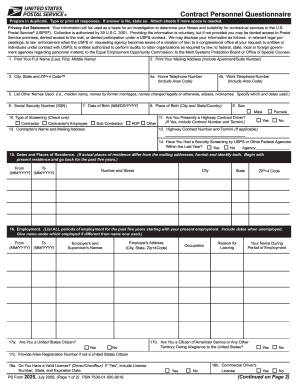

Garnishment Policy Templates are pre-designed documents that outline the guidelines and procedures for handling wage garnishments within a company. These templates provide a structured framework for employers to follow when responding to legal orders to withhold a portion of an employee's wages for debt repayment.

What are the types of Garnishment Policy Templates?

There are several types of Garnishment Policy Templates available, including:

Standard Garnishment Policy Template

Government-issued Garnishment Policy Template

Industry-specific Garnishment Policy Template

How to complete Garnishment Policy Templates

Completing Garnishment Policy Templates is a straightforward process that involves the following steps:

01

Download a Garnishment Policy Template from a reputable source.

02

Fill in the required fields with your company's information.

03

Review the completed template for accuracy and compliance with legal requirements.

04

Save and share the finalized Garnishment Policy Template with relevant stakeholders.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Garnishment Policy Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

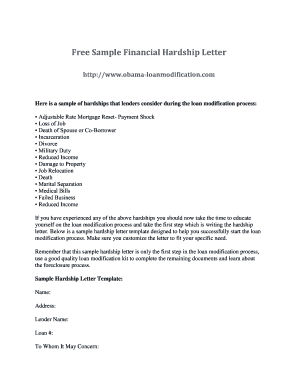

What are the ways around garnishment?

If a court has awarded judgment to your creditor and garnishment is part of the plan, here are some potential ways to get rid of it. Pay Off the Debt. Work With Your Creditor. Challenge the Garnishment. File a Claim of Exemption. File for Bankruptcy.

Is there a way around wage garnishment?

Act quickly to prevent wage garnishment You can file a Claim of Exemption any time after wage garnishment has started, but you'll only get wages back from the time after you submit the claim. If you act quickly, you can stop it before it even starts. By law, your employer cannot fire you for a single wage garnishment.

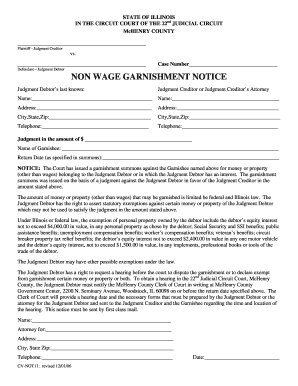

How do you get around a garnishment?

You can stop a garnishment by: Paying off the debt in full. Filing an objection to the garnishment with the court if you have legal basis, such debt was a result of fraud or identity theft. Filing for court protection and debt resolution through Chapter 13 or Chapter 7 bankruptcy.

How do I protect my money from garnishment?

Open a Bank Account in a State That Prohibits Garnishments A judgment debtor can best protect a bank account by using a bank in a state that prohibits bank account garnishment. In that case, the debtor's money cannot be tied up by a garnishment writ while the debtor litigates exemptions.

Can you negotiate wage garnishment?

It is sometimes possible to negotiate a wage garnishment directly with the creditor. Most creditors want to recoup as much of their debt as possible and may be willing to work out a deal. Build your argument before approaching the creditor.

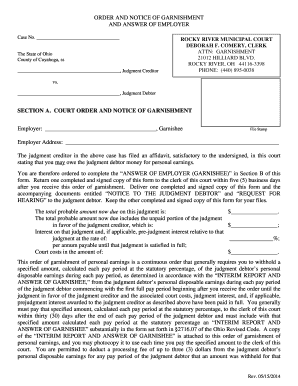

How do I write a letter of garnishment?

Include the person's name in Human Resources if you have it. Begin the letter referencing the employee whose wages should be garnished, the debt and the person who is owed the debt. Your Writ of Garnishment/Execution should have already been served by the county's Sheriff, so you can include those details as well.