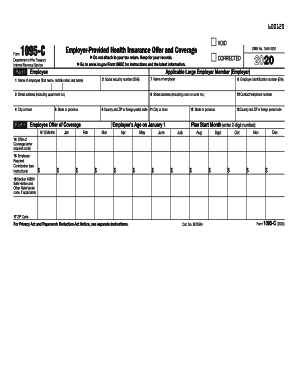

What is 1095-a form pdf?

The 1095-A form is a tax form used to report information about your health coverage if you or someone in your household enrolled in a Marketplace plan. It is important for tax purposes as it helps determine if you are eligible for premium tax credits or require to pay back some of the credits received.

What are the types of 1095-a form pdf?

There is only one type of 1095-A form. It is a standard form provided by the Healthcare Marketplace to individuals who enrolled in a Marketplace plan. The form contains details about the coverage, including the months covered, the amount of premiums paid, and any premium tax credits received.

How to complete 1095-a form pdf

Completing the 1095-A form can seem daunting at first, but with a couple of simple steps, you can quickly and accurately fill it out. Below is a step-by-step guide to help you complete the form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.