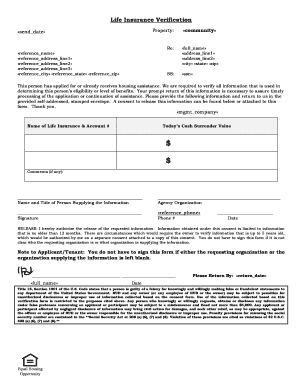

Free Printable Insurance Verification Form

What is Free printable insurance verification form?

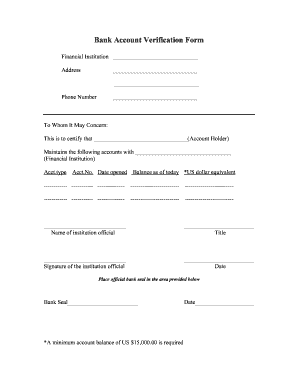

A Free printable insurance verification form is a document used to provide proof of insurance coverage to a third party, such as an employer, government agency, or healthcare provider. It typically includes details about the insured party, the insurance policy, and coverage limits.

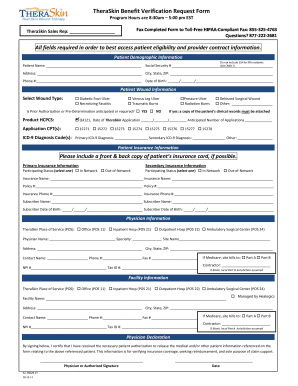

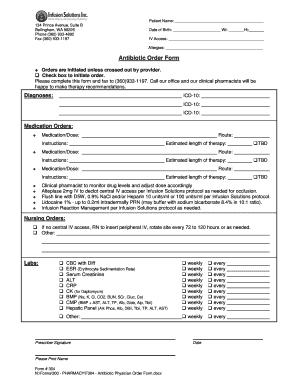

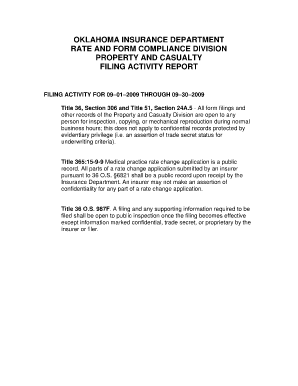

What are the types of Free printable insurance verification form?

Free printable insurance verification forms can vary based on the type of insurance coverage being verified. Some common types include:

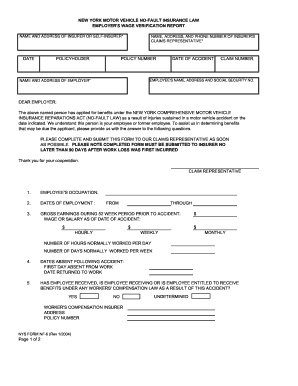

Auto insurance verification form

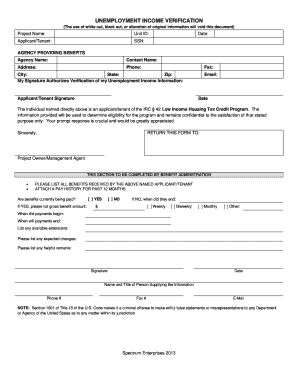

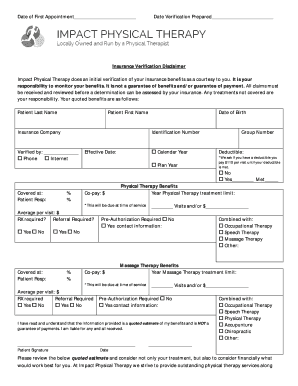

Health insurance verification form

Home insurance verification form

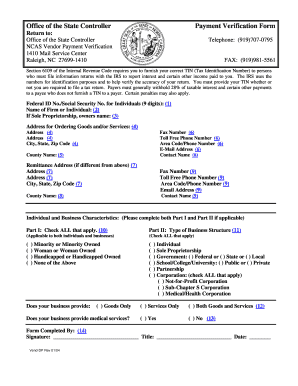

General liability insurance verification form

How to complete Free printable insurance verification form

To complete a Free printable insurance verification form, follow these steps:

01

Gather all necessary information, including policy number, insured party details, and coverage dates

02

Fill out the form accurately and completely, ensuring all information is legible

03

Review the completed form for any errors or missing information

04

Sign and date the form where required

05

Submit the form to the requesting party

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Free printable insurance verification form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Why is it important to verify a patient's eligibility for benefits?

Without this information, healthcare services will be interrupted. Verification of insurance eligibility is necessary as it is directly linked to claim denials or payment delays of any healthcare services. The claim denial and payment delays occurs when eligibility checking is not done correctly and efficiently.

What is the first step required to verify patient eligibility?

Step 1 – Collect the Patient's Insurance Information The billing team needs to ask appropriate questions during insurance eligibility verification to collect the relevant information, such as: Facilities must adhere to the hospital's insurance verification training manual.

What is the benefit verification process?

Patient eligibility and benefits verification is the process by which practices confirm information such as coverage, copayments, deductibles, and coinsurance with a patient's insurance company.

What is the first step required to verify patient eligibility?

Begin the process of collecting insurance eligibility verification information by asking for a copy of new insurance information from the patient. It's a good idea to ask for a copy of the card even if the patient states that insurance hasn't changed.

What does verification of benefits mean in medical terms?

Benefits verification is the process of checking a patient's active insurance coverage and benefits with an insurance company before various procedures to ensure reimbursement.

What is the process of verifying a patient's insurance?

Medical Insurance Verification Process Copy both the front and back of the patient's insurance card. Add the patient to the EHR, PM or RTE tool. Add the patient's insurance information into the EHR, PM or RTE tool. Check the patient's eligibility electronically by selecting the appropriate benefit and service type.