Insurance Verification Form Templates

What are Insurance Verification Form Templates?

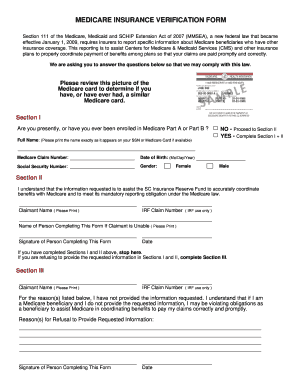

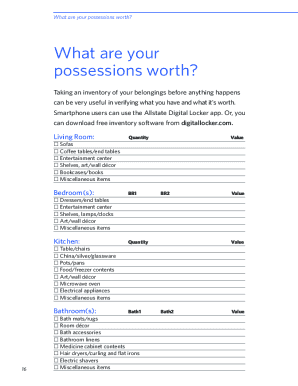

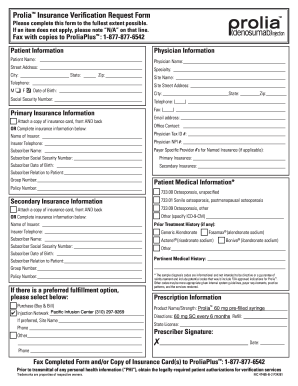

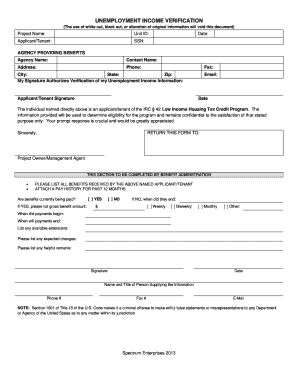

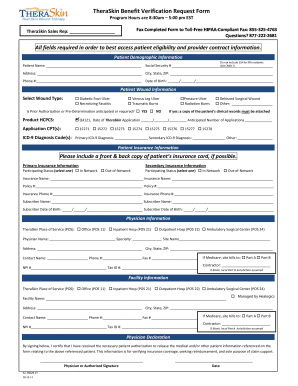

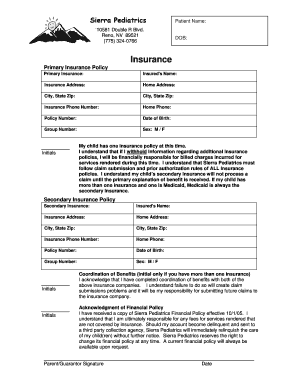

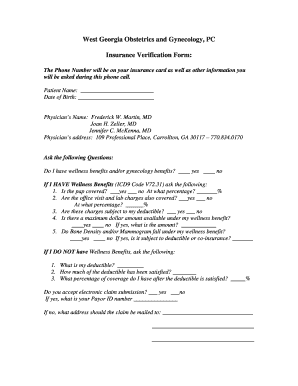

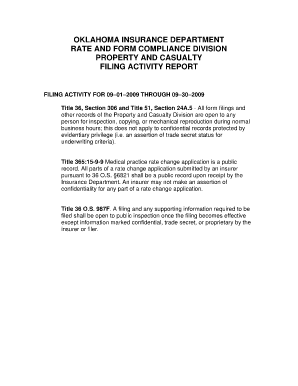

Insurance verification form templates are pre-designed documents that individuals and businesses can use to gather essential information from clients for insurance purposes. These templates streamline the process of collecting relevant details necessary for verifying insurance coverage.

What are the types of Insurance Verification Form Templates?

There are several types of insurance verification form templates available to cater to different industries and needs. Some common types include:

How to complete Insurance Verification Form Templates

Completing insurance verification form templates is a straightforward process that can be done efficiently with the right tools and guidance. Here are some steps to help you fill out these forms accurately:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.