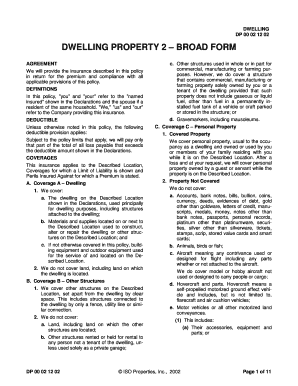

Broad Form Property Insurance

What is Broad form property insurance?

Broad form property insurance is a type of insurance coverage that protects against a wide range of risks to property, including damage from fire, theft, vandalism, and certain natural disasters. It provides broad coverage for a variety of potential perils, offering comprehensive protection for your property.

What are the types of Broad form property insurance?

There are several types of Broad form property insurance policies available to suit different needs and preferences. Some common types include:

How to complete Broad form property insurance

Completing Broad form property insurance is a straightforward process that can provide peace of mind knowing your property is protected. Here are some steps to help you complete the process:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.