Sample Letter For Car Insurance Quotation

What is Sample letter for car insurance quotation?

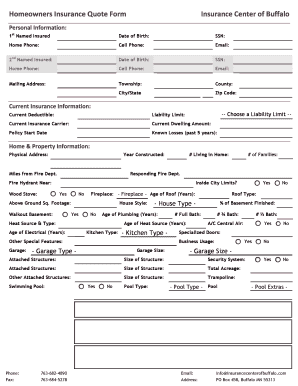

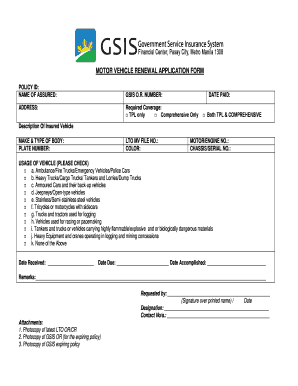

A sample letter for car insurance quotation is a document that you can use to request a quote for your car insurance coverage. It typically includes details about your vehicle, driving history, and desired coverage options.

What are the types of Sample letter for car insurance quotation?

There are several types of sample letters for car insurance quotations, including:

Standard quotation letter requesting a quote for car insurance

Detailed quotation letter with specific coverage requirements

Budget-friendly quotation letter seeking cost-effective insurance options

How to complete Sample letter for car insurance quotation

To complete a sample letter for car insurance quotation, follow these steps:

01

Start by addressing the insurance company or agent

02

Provide details about your vehicle, such as make, model, and year

03

Include information about your driving history and any previous insurance coverage

04

Specify the type of coverage you are looking for, such as liability, comprehensive, or collision

05

End the letter with a polite request for a timely response

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Sample letter for car insurance quotation

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do you write an insurance quote?

In the quotation form, you also need to specify the dwelling details. Plus, you need to explicitly state everything about policy coverage and give information on underwriting. Lastly, you should write details of the additional policy or coverage notes.

How do you write an insurance company quote?

In the quotation form, you also need to specify the dwelling details. Plus, you need to explicitly state everything about policy coverage and give information on underwriting. Lastly, you should write details of the additional policy or coverage notes.

What is an insurance quotation?

a statement of the amount of money that an insurance company calculates as the cost of providing insurance for something: Get an immediate insurance quote for your car by calling us now or visiting our website.

How do you present an insurance quote?

1:36 6:22 How To Present Your Auto Insurance Quote When You're More Expensive! YouTube Start of suggested clip End of suggested clip It looks like it was going to be about 230. Dollars per month for your insurance. So you give them aMoreIt looks like it was going to be about 230. Dollars per month for your insurance. So you give them a high price first. And then you say however since you don't have any accidents. No tickets.

How do I write to an insurance company?

In order to write a successful insurance claim letter, start with an introduction who you are, why you are writing, contact information and the details on your property. This will help the insurance adjuster understand the most important details and how to get in touch with you when there are questions.

How do you write a professional letter to an insurance company?

7 Tips for Writing a Demand Letter To the Insurance Company Organize your expenses. Establish the facts. Share your perspective. Detail your road to recovery. Acknowledge and emphasize your pain and suffering. Request a reasonable settlement amount. Review your letter and send it!