Flood Insurance Quote Online Fema

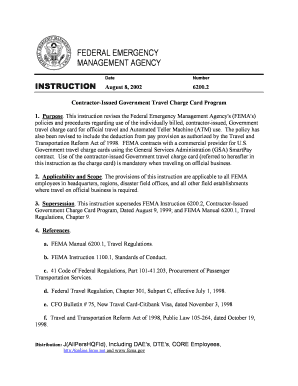

What is Flood insurance quote online fema?

Flood insurance quote online FEMA is a service provided by the Federal Emergency Management Agency (FEMA) that allows individuals to obtain quotes for flood insurance online. This makes it easier for homeowners and property owners to assess their flood insurance needs and make informed decisions about coverage.

What are the types of Flood insurance quote online fema?

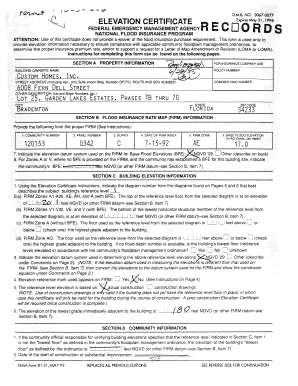

There are several types of flood insurance quotes available online through FEMA. Some include: 1. Standard Flood Insurance Policy (SFIP) 2. Preferred Risk Policy 3. Residential Condominium Building Association Policy 4. Residential Condominium Unit Owner Policy Each type offers varying levels of coverage to suit different property types and needs.

How to complete Flood insurance quote online fema

Completing a flood insurance quote online through FEMA is a simple process that can be done in a few easy steps. 1. Visit the FEMA website and navigate to the flood insurance quote section. 2. Enter your property information, including location and type of coverage needed. 3. Review the quote options provided and select the policy that best fits your needs. 4. Complete the online application and payment process to finalize your flood insurance policy.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.