Floodsmart Insurance

What is Floodsmart insurance?

Floodsmart insurance is a specific type of insurance that provides coverage for damages caused by floods. It is designed to help individuals and businesses protect themselves financially in the event of flooding.

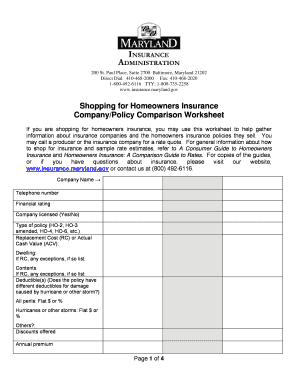

What are the types of Floodsmart insurance?

There are different types of Floodsmart insurance available to cater to the diverse needs of customers. Some common types include:

Standard Flood Insurance

Preferred Risk Policy

Emergency Program

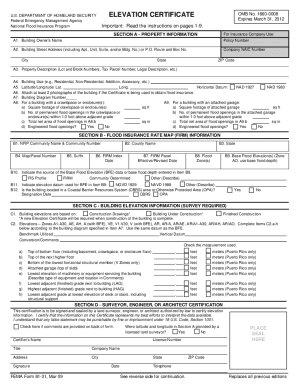

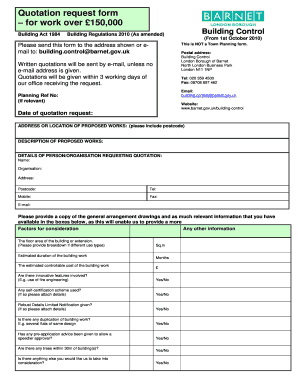

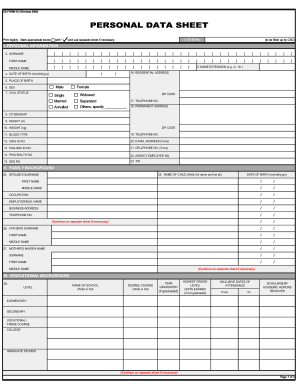

How to complete Floodsmart insurance

Completing Floodsmart insurance is a straightforward process that can be done with the help of pdfFiller. Here are the steps to complete Floodsmart insurance:

01

Visit the pdfFiller website

02

Choose a Floodsmart insurance template

03

Fill in the required information

04

Review the completed form

05

Save, print, or share the document

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Floodsmart insurance

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the main purpose of the Floodsmart program?

The Federal Emergency Management Agency's (FEMA's) National Flood Insurance Program is a federal program enabling property owners in participating communities to purchase insurance as a protection against flood losses in exchange for state and community floodplain management regulations that reduce future flood damages

Which of the following is not covered under flood insurance?

Property and belongings outside of an insured building, such as trees, plants, wells, septic systems, walks, decks, patios, fences, seawalls, hot tubs, and swimming pools. Currency, precious metals, and valuable papers, such as stock certificates.

What is the intent of the National Flood Insurance Program?

The NFIP provides flood insurance to property owners, renters and businesses, and having this coverage helps them recover faster when floodwaters recede. The NFIP works with communities required to adopt and enforce floodplain management regulations that help mitigate flooding effects.

What is the primary purpose of the NFIP?

The NFIP has two main policy goals: (1) to provide access to primary flood insurance, thereby allowing for the transfer of some of the financial risk from property owners to the federal government, and (2) to mitigate and reduce the nation's comprehensive flood risk through the development and implementation of

Which of the following is an important benefit of flood insurance?

Flood insurance provides funding to repair flood-damaged property without the need to draw down savings, take on debt, or rely on often insufficient and delayed assistance from the federal government.

What is the purpose of the NFIP quizlet?

federal government program to provide a direct loss flood insurance at subsidize rates. ~purpose is to encourage communities to practice flood control & to restrict development in flood prone areas by denying program participation to communities that do not meet the flood insurance program requirments.