What Is Broad Form Car Insurance

What is broad form car insurance?

Broad form car insurance is a type of auto insurance policy that offers coverage for specific drivers rather than specific vehicles. With broad form insurance, the policyholder is covered when driving any car, whether it is owned by them or someone else. This type of policy is typically used by individuals who do not own a car but still drive frequently.

What are the types of broad form car insurance?

There are two main types of broad form car insurance policies:

Named Operator Policy - This policy covers a specific individual regardless of the vehicle they are driving.

Non-Owned Car Policy - This policy covers individuals driving cars they do not own, such as a rental or borrowed vehicle.

How to complete broad form car insurance

To obtain broad form car insurance, follow these simple steps:

01

Research insurance providers that offer broad form coverage.

02

Compare quotes and coverage options to find the best policy for your needs.

03

Contact the chosen insurance provider to initiate the application process and provide necessary information.

04

Review and sign the policy documents once approved.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out What is broad form car insurance

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is broad form full coverage?

Broad form insurance, often referred to as broad form named operator insurance, is a type of basic liability coverage that can fulfill your state's minimum liability requirements for auto insurance. This type of policy covers only the driver's liability costs.

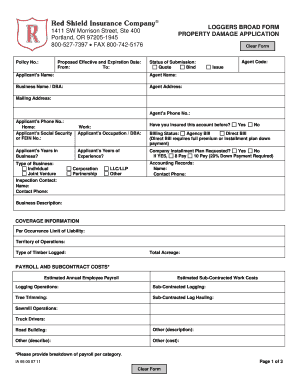

What does broad form property damage cover?

A broad form property damage endorsement refers to, among other things, liability coverage for damage from work performed by subcontractors on behalf of owners and general contractors.

What additional perils are covered under broad form?

Common Broad Named Perils Burglary/Break-in damage. Falling Objects like tree limbs. Weight of Ice and Snow. Freezing of Plumbing. Accidental Water Damage. Artificially Generated Electricity.

What is the difference between basic and broad form coverage?

Broad form is more extensive than basic or a “Gold-level” package, but not as comprehensive as special. It incorporates coverages for the hazards under basic form with multiple additions. As with a basic form policy, broad only covers named perils. If the coverage is not named in the policy, it will be excluded.

What perils are excluded on a broad form?

Broad form covers the same 11 perils, but adds 6 more: Falling objects, Weight of ice, snow or sleet, accidental discharge or overflow of water or stream from within plumbing or related systems. does not include discharge or overflow of water from a sump, sudden and accidental rupture of heating, air conditioning, fire

What is the difference between broad collision and comprehensive?

If you hit another car or a stationary object like a telephone pole (or if you roll over), you'll be covered by collision insurance. If an animal or a non-stationary object such as a falling tree hits your car or it's damaged by vandalism, fire or a natural disaster, you'll be covered by comprehensive insurance.