Nonprofit Merger Term Sheet

What is a Nonprofit merger term sheet?

A Nonprofit merger term sheet is a document outlining the terms and conditions of a proposed merger between two nonprofit organizations. It includes details such as the purpose of the merger, the assets and liabilities to be transferred, and the governance structure of the new entity.

What are the types of Nonprofit merger term sheet?

There are two main types of Nonprofit merger term sheets: asset acquisition term sheet and stock acquisition term sheet.

Asset acquisition term sheet

Stock acquisition term sheet

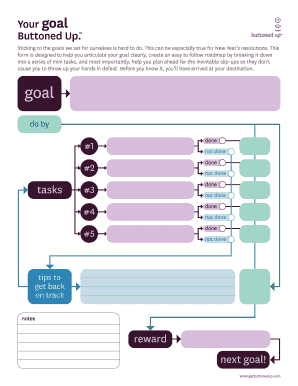

How to complete a Nonprofit merger term sheet?

To complete a Nonprofit merger term sheet, follow these steps:

01

Gather all relevant information about the organizations involved

02

Negotiate the terms with the other party

03

Consult with legal and financial advisors

04

Finalize the terms and sign the document

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Nonprofit merger term sheet

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can a nonprofit merge with another nonprofit?

Dictated by state nonprofit corporation law, approval is usually in two steps, by the boards and then by the memberships. The governing board of a merging organization will usually consider the impending merger at two or more meetings before it is comfortable considering approval of the merger.

Can you merge two non profits?

Nonprofit mergers are generally collaborative transactions and are usually intended to combine the respective strengths of two or more organizations to streamline operations or to capitalize on economies of scale.

What is an example of a nonprofit merger?

The Eleanor Foundation ($5–6m) merged into the Chicago Foundation for Women ($6–7m) in 2012 to form a “strategic alliance.” The two “joined forces” because together they could do far more to help female-headed households reach the middle class than operating separately.

What are the benefits of a nonprofit merger?

A well-executed merger can create strategic growth, shore up their financial position, and help increase impact and mission success. Using these strategies will help make sure your organization does not suffer setbacks and struggle with lasting problems from a poor merger.

What is a nonprofit acquisition?

Increasingly, nonprofits are considering merging with, acquiring, or being acquired by other organizations. These types of transactions in which an organization acquires the equity or assets of another are generically referred to in this article as “M&A,” or when a nonprofit is involved, “nonprofit M&A.”

What is the difference between a nonprofit merger and acquisition?

A merger is a statutory term that refers to when two organizations go forward as a single firm rather than remaining separately owned and operated. An acquisition describes a transaction where one organization purchases another and incorporates it into its operational structure.